When Porinju Veliyath announced on 22nd July 2015 that he had bought 200,000 shares of Gokaldas Exports at Rs. 67.81 each, people were not impressed. The reason for this was because Gokaldas, a micro-cap textile company with a market capitalisation of Rs. 300 crore, had a notorious reputation for destroying investors’ wealth.

Blackstone Private Equity, one of Gokaldas’ major shareholders, had made a huge investment of $165M in Gokaldas. It lost 75% of the investment.

However, Porinju, who likes to think of himself as a maverick investor/ trader, was not deterred by Gokaldas’ past track record. Instead, he pumped in Rs. 1.35 crore into the stock and also took a dig at the purists who prefer so-called “high quality” companies like Kitex Garments despite their exorbitant valuations.

NewGen Investors feel safe to buy Kitex at 4200 Cr; they have 20 reasons not to look at Gokaldas Exports at 200 Cr, due to current problems!

— Porinju Veliyath (@porinju) July 22, 2015

Today, Porinju had reason to rejoice because Gokaldas spurted a magnificent 20% on the back of robust Q4FY16 numbers. The revenue in Q4FY16 grew 23% YoY to Rs. 318 crore while the PAT increased to Rs. 41 crore as compared to Rs. 35 crore in Q4FY15. For the entire FY16, the revenue grew 5% while the PAT increased to Rs. 61 crore as compared to Rs. 34 crore.

| Gokaldas Exports Ltd – Q4FY16 Financial Results | |||

| Particulars (Rs.cr) | Mar 2016 | Mar 2015 | % Chg |

| Net Sales | 317.81 | 257.6 | 23.37 |

| Other Income | 4.04 | 49.14 | -91.78 |

| Total Income | 321.84 | 306.74 | 4.92 |

| Total Expenses | 275.05 | 253.09 | 8.68 |

| Operating Profit | 46.79 | 53.65 | -12.79 |

| Net Profit | 40.77 | 34.84 | 17.02 |

| Equity Capital | 17.39 | 17.3 | – |

(Source: Business Standard)

The Company also stated that its order book is “significantly better”. It also promised to work towards growing the top-line and improving profitability in the future.

The results and management commentary clearly suggest that Gokaldas is firmly on the road to recovery and that one can expect to see better days ahead.

In hindsight, Porinju’s strategy was a sound one. When he bought the stock, Gokaldas was at the bottom of the barrel and there were no expectations from it. Even if the results were disappointing, there would not have been much adverse reaction. However, a slight improvement in performance has excited investors and everyone wants to have a slice. Such stocks are probably what Mohnish Pabrai referred to as “Heads I Win, Tails I Don’t Lose Much” stocks.

Porinju did not miss the opportunity to again take a dig at the purists who had advocated buying Kitex Garments.

Interesting thought an year ago – Kitex down 50%, Gokaldas up 50%, and counting…https://t.co/UCbFw9XcyQ

— Porinju Veliyath (@porinju) May 31, 2016

This is an opportune time for us to take account on how the other textile stocks which are favourites of expert investors are faring:

| Textile Stock | Investor | YoY Gains (%) |

| AYM Syntex (Welspun) | Ashish Kacholia | 127 |

| RSWM | Dolly Khanna/ Anil Kumar Goel | 68 |

| Nandan Denim | Dolly Khanna | 65 |

| Golkaldas Exports | Porinju Veliyath | 62 |

| Nitin Spinners | Dolly Khanna | 34 |

| Ambika Cotton | Prof Sanjay Bakshi | (13) |

| Amarjothi | Anil Kumar Goel | (20) |

| Kitex Garments | Prof Sanjay Bakshi | (51) |

As one can see, Ashish Kacholia rules the roost with his stock pick AYM Syntex (formerly Welspun Syntex) having delivered magnificent gains of 127%. Dolly Khanna is at second place with two of her stocks having delivered gains in excess of 60%. Porinju comes a close third.

Sadly, Prof Sanjay Bakshi, the authority on value investing, is at the bottom of the barrel with one of his stock picks having lost in excess of 50%. His other textile stock is also in the doldrums owing to so-so Q4FY16 results.

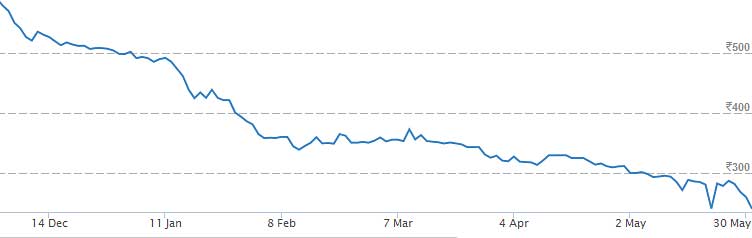

The unfortunate aspect is that even the other stocks in portfolio of the Prof/ ValueQuest India Moat Fund are buckling under heavy selling pressure. Vaibhav Global, one of the Prof’s favourite stocks, lost nearly 10% today after a gloomy investors’ conference call. The stock hit a 52-week low of Rs. 235. it has lost 60% on a YoY basis.

(Vaibhav Global’s six month chart)

What appears to be ailing the Prof’s stocks is the fact that they were high-flying stocks with a lot of expectations built into them. For instance, Kitex Garments was referred to as “the next Page Industries” by several experts. Even Vaibhav Global was expected to revive its past glory and become a multi-bagger all over again. The expectations have not been met and so the stocks have come crashing down. The same fate has befallen the two realty stocks in the Prof’s portfolio.

We will have to keep a keen watch to see whether the Prof is induced to change his investment strategy of buying ‘high quality’ stocks at high valuations or whether he tweaks his strategy in some other manner.

Dear Arjun…Ashish Kacholia brought AYM syntex at a much higher price of around 125 rupees in 2015… The stock is trading flat since last year and has not delivered since then

I agree with the remaining data…RSWM, Nandan Denim ,Gokaldas exports delivered superior returns.. Thanks once again for analysing … wonderful website

arjun, please get your facts right yaar, as owner of this fine website, you owe others. Ashish does NOT have 127% gains, he bought at 125, check what is the stock price now, after crashing for the past few months, it is trying to regain lost ground, long way to go,

Arjun you have a bad habit of going over the top, praising others too much where none is required.

#Niveza #Review on #Stock #Market #Tips ::

Keeping the controversies of Gokaldas Exports Ltd aside, the fundamentals are looking much better. The stock is highly undervalued at current levels trailing with PE of 4.68x which is decent considering the market. But the point of concern for the company is the revenue growth. Over last five years, revenue grew at negative cagr of 1.22 per cent. Ignoring the revenue growth, FY15 was the first profit making year for the company. March quarter result again favored with 23.37 per cent growth in the revenue. Now better days have been started for the company, considering the current expansion plans and declining debt, it is emerging as a multibagger stock. But entering at current levels is somehow difficult as the stock spiked more than 36 per cent in last two days. One should enter after factoring all risks.

Visit@ Multibagger Stock Ideas

Arjun,

Rather than writing almost 1 stock idea daily from celebrity investor(s) you should compile list of last 12 months ideas from any celebrity investor and go on adding new selection as and when you find/reported.

Eventually you would know of 100 bets/darts 2-3 becoming multi-baggers. That is worst than doing NIFTY ETF investing.

Well dude only 2 or 3 out of 10 usually perform that’s the reason why it is told to always diversify your investments. If you can do better than this then you are doing better than pros.

Porinju gonna make killing profits if this turnaround becomes successful. Looking at his past stocks it does looks feasible.

Hi Arjun, may be you may like to write about Reliance Mutual Fund’s picking up stake (on behalf of Reliance Nippon Life Insurance) of 6.4% into Good Luck Steel Tubes, spending a fairly good 13.4 crores, just two days back. I have seen the finances and fundamentals of the company. It is very good. Trades at MCap of about one fifth of the topline. And just a quarter ago the first FII bought a 2% stake in the same company.