Bears sabotage Index to camouflage real state of market

A few days ago, there were festivities in Dalal Street that the Nifty had finally crossed the level of 11,000.

Sonia Shenoy announced the historic moment in her typical succinct style.

Nifty crosses 11000

— Sonia Shenoy (@_soniashenoy) February 6, 2019

According to experts in technical analysis, the 11,000 mark is a significant barrier and crossing it signals that the Nifty will now effortlessly coast in an upward trajectory.

However, Surabhi Upadhyay, who also meticulously tracks the markets, sounded the caution that there is no justification for cheer because the broader market is bleeding profusely.

She pointed out that nearly 40% of the Nifty stocks have lost up to 20% since the beginning of the year.

#Nifty at 11000 again, but…

40% of #Nifty50 stocks down 5-20% since start of 2019

SO FAR THIS YEAR

Nifty: 1.4%

Bank Nifty: 0.8%

Nifty Junior: -5.9%

Midcap Index: -6.5%

Smallcap Index: -7.3%

MEANWHILE#Dow: 8.9%#Nasdaq: 11.5%

MSCI EM: 9%

Brazil: UP 29% !!#stocks #stockmarket— Surabhi Upadhyay (@SurabhiUpadhyay) February 6, 2019

This analysis is corroborated by other knowledgeable persons.

Nifty Was at 11000 Last on Oct 1, 2018

However, 30 Nifty Stocks below Oct 1 LevelsREAL STORY IN MIDCAPS

F&O Stocks Since Oct 1:

5 stocks lost >50%

21 stocks lost b/w 20-50%

62 stocks lost b/w 0-20%Market Cap of BSE Stocks

Oct 1: 145.4 Lk Cr

Now: 140.8 Lk Cr

Net: -4.6 Lk Cr— Mangalam Maloo (@blitzkreigm) February 6, 2019

REAL STORY IN MIDCAPS

Since Oct 1:

DHFL -62%

Dish Tv -61%

Rel Power -55%

Rel Comm -54%

Infibeam -51%

Srei Infra -38%Since Oct 1:

INDIGO +46%

KAJARIACER +44%

ORIENTBANK +43%

JETAIRWAYS +38%

PVR +30%#Nifty— Mangalam Maloo (@blitzkreigm) February 6, 2019

Nifty around 11000, but most of F&O stocks much below the price than it was at 9000 in Aug 2016. pic.twitter.com/FlmwgiAVXe

— P R Sundar (@PRSundar64) February 5, 2019

It is also notable that several worthies like DHFL, Dish TV, Reliance Power, Reliance Communication, Infibeam, Srei Infra have lost massive chunks of their valuation and contributed to the poverty of investors.

According to Nupur Acharya of ET, only a handful of stocks, including RIL and Infosys and TCS, have driven the gains.

She quoted Dharmesh Kant of Indianivesh to say that the market is behaving in a “bipolar” manner.

“The uncertainty around elections, concerns regarding leveraged companies and possible debt defaults is dragging down the broader market,” Dharmesh Kant said.

Porinju Veliyath outperforms Basant Maheshwari

It is no secret that we are interested in the performance of only two funds, which is of Porinju Veliyath and Basant Maheshwari.

This is because the two stalwarts regularly feed us with multibagger stock tips and keep us in good humor.

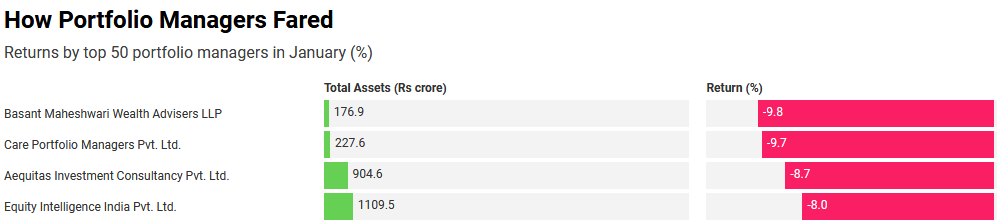

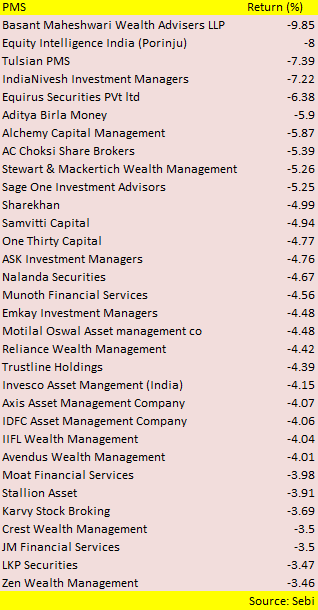

According to the latest research conducted by the sleuths of Bloomberg, Basant Maheshwari’s PMS Fund lost 9.8% in January 2019 while Porinju Veliyath’s PMS Fund lost only 8%.

In fact, Porinju outperformed two other PMS Funds named ‘Care Portfolio Managers‘ and ‘Aequitas Investment Consultancy‘.

It is notable that Porinju manages an AUM of Rs. 1109 crore while Basant has only Rs. 177 crore in his kitty.

However, while Porinju has seen his AUM shrink from Rs. 1246 crore (in October 2018), Basant’s AUM has remained steady.

Amongst the larger PMS funds, Quantum Advisors put up a stellar show with an AUM of Rs. 14,193 crore and a loss of only 2.2%.

ENAM, Motilal Oswal and ASK also impressed with AUMs in excess of Rs. 12,000 crore and a loss of only about 3-5%.

A PMS Fund known as Anvil Wealth Management, with an AUM of 541 crore, was the only one to post a positive return of 3.2% during the tumultuous period.

So almost all PMS managers lost money in Jan

India’s Portfolio Managers Begin The Year With Midcap Blueshttps://t.co/mF3PHlwm1e

— Darshan Mehta (@darshanvmehta1) February 8, 2019

A similar analysis of the performance of the PMS funds has been conducted by the sleuths of ET.

Excess concentration by Basant caused the heavy loss?

Now, we have the onerous duty of trying to understand why Basant has underperformed his distinguished peers.

In fact, in an earlier interaction with one of his followers, Basant had revealed that his Fund is up 13.27% YTD and has a since inception CAGR (post fee weighted avg AUM) of 23.34%.

You are an ill-informed idiot to be making irresponsible comments. So just shut up. Because you’re in a hole doesn’t mean everyone else is. We’re up 13.27% YTD & have a since inception CAGR (post fee weighted avg AUM) of 23.34%.

*Past performance is no guarantee to future returns https://t.co/Uflxad03UE— Basant Maheshwari (@BMTheEquityDesk) December 30, 2018

However, this appears to have changed now.

Prima facie, we can pin the blame on D-Mart alias Avenue Supermart.

Basant has revealed that D-Mart is his top holding across portfolios.

Basant Maheshwari, @BMTheEquityDesk , says Avenue Supermart is our top holding across portfolios

— CNBC-TV18 (@CNBCTV18Live) April 30, 2018

Unfortunately, D-Mart reported so-so Q3FY19 results and this resulted in a sell-off given its alleged exorbitant valuations.

To justify the PE Ratio of 80+ that #AvenueSupermart trades at it needs to grow earnings by 40% plus for the next 10 years.

Last quarter results were bad. This quarter disastrous with just 2% earnings growth. This is when they are not spending big on expansions

Value below Rs 800— sandip sabharwal (@sandipsabharwal) January 12, 2019

Edelweiss On Avenue Supermart

Increasing Competition To Make Incremental Margin Expansion Difficult

Store Addition Pace Slower Than Expected

Retain Reduce, TP Rs 1300@blitzkreigm @CNBCTV18News— Nimesh Shah (@nimeshscnbc) January 14, 2019

CS On Avenue Supermart

U-P, TP Rs 1150

Another Major Miss, now 2 In A Row

Will Struggle To Expand Or Even Maintain Margin

Heavy Discounting Led Gross Margin Fall 170 bps YoY

Most Worrying Is Pace Of New Store Addition; Down 10% YoY In 9MFY19

Cut FY19 EPS E By 7%@blitzkreigm— Nimesh Shah (@nimeshscnbc) January 14, 2019

MOTILAL OSWAL SECURITIES : Have a neutral stance on Avenue Supermart on back of valuations

— ET NOW (@ETNOWlive) August 1, 2017

In an earlier interview, Basant has made it clear that if high P/E stocks stop delivering on growth, he will not hesitate to put them on the Guillotine.

“The moment we see that the growth has started to slip, we will come out of it and buy something better maybe,” he said.

Whether D-Mart will find itself on the Guillotine or not has to be seen.

Basant also appears to have been disappointed by Bajaj Finance and PNB Housing.

He has revealed that he has aggressively bought both stocks “up to the neck“.

However, the ongoing liquidity crises and fear of NPAs as regards realty loans (LAPs), has caused both stocks to stay sluggish.

Perturbed by crash but have to stay in game

Basant candidly admitted that even he is perturbed by the savage crash in stock prices.

However, he advised that we have to be an ‘optimist‘ and stay in the game because one never knows when the tide will turn.

Thank you. We also get perturbed with falling prices but have learnt that the best way to remain in the game is by being an optimist.

— Basant Maheshwari (@BMTheEquityDesk) December 27, 2018

It’s sad but normal. We all lose money in the market. Staying in the market is more important than being there. Sometimes you might need to ask yourself ‘Did I lose because this market isn’t a good place to be in or was it because I didn’t know how to play the game’ ?

— Basant Maheshwari (@BMTheEquityDesk) December 30, 2018

Basant also advised us to give up our obsession for “multibaggers” and instead to focus on “compounders“.

Lot of people went broke looking for multibaggers. A multibagger is like a full toss in cricket.If you get one put it on the stadium’s roof if not keep scoring at the desired run rate. Trying to hit every ball out of the park will put you out of action very soon. Be careful. https://t.co/e9fxsotnCk

— Basant Maheshwari (@BMTheEquityDesk) January 1, 2019

Porinju was betrayed by LEEL & Chor promoters

It may be recalled that Porinju has recently addressed a letter to his clients in which he candidly admitted that he has been outwitted by the alleged “Chor” promoters of LEEL.

He described LEEL as a “costly misjudgement” which has resulted in “permanent loss of capital” of nearly 80% of the investment (see Chor Promoter Did Fraud & Caused Massive Loss: Porinju Veliyath Fumes & Vows To Bring Them To Book).

In the wake of Porinju’s bitter experience with the alleged chor promoters, some fund managers have laid down strict pre-conditions before such stocks can be touched.

‘Chor bane mor’ is an exceptions based strategy. Should never be the norm. And there are absolute certain pre-conditions 1. Business has strong cash flows, 2. Yours and promoters interests are aligned. One should never bet on someone’s integrity changing.

— Ravi Dharamshi (@ravidharamshi77) February 7, 2019

The valuations have to be so compelling that it is worth our while to dabble with the chors.

There are valuations and there are valuations. Imagine getting 50% of spirits and beer market at 200crs.

— Ravi Dharamshi (@ravidharamshi77) February 7, 2019

Thesis playing out as expected and most of the Chors which turned Mor in Bull market has turned Chor again in bear market. This cycle keeps on repeating and many investors keep getting trapped again and again https://t.co/JbWGVk51ny

— RJ (@ravijain88) February 8, 2019

Prima facie, it is advisable for novices like us to keep a safe distance from the chors because if they can outwit stalwarts like Porinju, they will probably eat us alive.

Will Porinju’s “Billion Dollar Co” change fortunes for his clients?

I pointed out earlier that Porinju Veliyath has recommended a stock which is said to at “Inflection Point” and has the potential to become a “Billion Dollar Co”.

The premise of the recommendation is that India is getting into a point of per capita income $3000 maybe in the next three to four years’ time.

Porinju opined that a “huge explosive growth in the discretionary spending” is on the way which will catapult his recommendation into the big league.

If that happens, Porinju’s beleaguered clients will be laughing on their way to the Bank and all losses will become a distant memory!

porinju has invested only in rotten stock like LEEL, HCL INFOSYSTEM, GVK POWER , ASHAPURA, EMKAY FINANCIAL ETC. not even a single company is in profit rather each stock has lost from 50% to 80% from their investement price. now he is not posting his last performance since inception. i have a gut feeling that he must have under performed nifty and sensex by a great margin.

I used to follow this blog..But the person writing this of should be avoided for your financial health…

When the minimum marks required to pass is 35…2 students got only 10 and 12 marks…both failed horribly …

New age media…first student outscores the other by 20%…

If they want to promote second one,they say he scores only 2 marks less..

End of the day both failed miserably …..its better to pick stocks based on our own assessment rather than following other guys

18 months back Porinju used to buy so called chor companies and it use to hit 20% circuit breaker… Now he buys anything it does not attract anybody’s interest.. It’s a question of survival for Porinju as whatever he bought has gone down.. If this continues he would not be called on TV and media would stop giving him coverage

Media loves porinju and his portfolio full of chor companies.Their main purpose is to entertain themselves and us…let the drama continue.

Porinjus penny stocks won’t recover in the next 2 decades whereas basants stocks will never quote at pe 40 or 80 again. A pe of 20 is what they deserve.Right now better to buy rj picks like Titan,lupin,escorts,etc etc etc

Moral of the story – do not take the Korinjus and Torinjus for granted. They too are humans and make mistakes. In a bull market these guys are heroes. In a collapsing market its the opposite.