Bombay Burmah Trading Corp (BBTC) – 1500% gain after Ashish Chugh’s recommendation

Ashish Chugh of Hidden Gems fame appears to be the first discoverer of Bombay Burmah Trading Corp’s potential to shower multibagger gains upon investors.

He recommended the stock in November 2011 when it was languishing at a throwaway price of Rs. 90 (adjusted for split).

“There is great value in Bombay Burmah. Investors should accumulate it at every decline,” he said in his typical soft-spoken voice.

Ashish Chugh gave detailed reasons in support of his recommendation.

However, the bottom line was that Bombay Burmah is the holding company of two powerhouse companies named Britannia Industries Ltd and Bombay Dyeing Ltd and that any surge in these two companies would translate into a surge in the stock of Bombay Burmah.

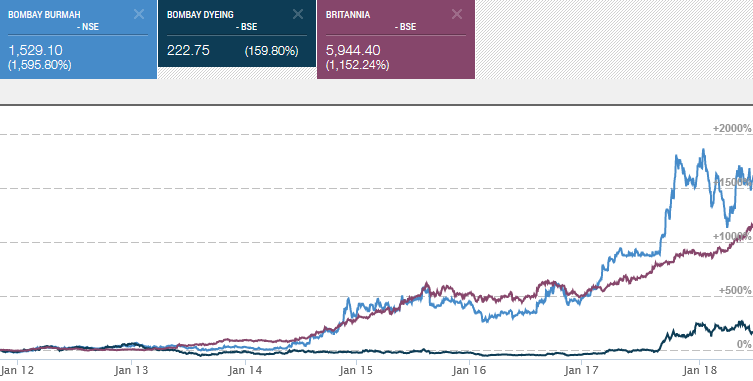

The logic was simply brilliant because Bombay Burmah has heavily outperformed Britannia and Bombay Dyeing.

While Britannia has given a gain of 1100% since November 2011, Bombay Burmah has given a gain of 1500% in the same period.

Holding companies will give massive gains: Porinju Veliyath

Porinju Veliyath formulated the theory in January 2017 that the steep discount at which holding companies are/ were quoting is not justified and that they are a compelling buy.

His logic was crisp and compelling:

“I feel in the year 2017, some holding companies will go up by 100 percent because of the deep discounts they are trading at. Some of them are from good corporate houses and in many cases the companies which they are holding, those companies are also on a high growth path and they are doing well. I have talked about Bombay Burmah Trading Corporation (BBTC), Bengal and Assam Company, Vindhya Telelink, Kalyani Investment Company etc. So investors can look at these companies and sometime when market goes into panic and such companies are trading at 70-80 percent or 90 percent discount to the net asset value (NAV), it will be a good opportunity. Those discounts are going to shrink and reward investors in this year.”

I see few solid holding companies with over 75% discount. They will double in 2017 as the discount would narrow down to 50%, explore!

— Porinju Veliyath (@porinju) January 26, 2017

Prediction comes true

Porinju’s prediction came true sooner than expected.

Many holding company stocks doubled in merely six months.

Value Investing is all about "Buying Rupee worth of assets by paying few Paise" – they doubled in 6 months! https://t.co/caVcRQkHsB

— Porinju Veliyath (@porinju) June 20, 2017

Thereafter, they went onto give more multibagger gains.

Holding Cos. was my big theme for 2017:

Forbes 1400 ➡️ 5000

BBTC 500 ➡️ 1600

Bengal & Assam 1000 ➡️ 2750

Vardhman, Dhunseri, Summit, STEL, BF, Zuari, Nahar, Kalyani, Pilani etc – all gained between 131% to 261%. Currently holding only Bengal & Assam. https://t.co/caVcRQkHsB— Porinju Veliyath (@porinju) December 28, 2017

BBTC gave 267% gain

Porinju realized that novices were confused about which holding company’s stock to buy.

So, to make life very simple for us, he cherry picked BBTC and recommended that we buy it.

He described it as the “simplest stock idea”.

BBTC @425 | perhaps the simplest stock idea!https://t.co/MjM1STUuDj

— Porinju Veliyath (@porinju) May 25, 2015

If we would have obediently followed his instructions, we would be richer by a mammoth 267%.

Varinder Bansal also recommended BBTC as a great buy (200% gain)

Varinder Bansal is regarded as an authority on holding company stocks. He was amongst the first to popularize the concept that holding companies make for great investment opportunities.

He also recommended BBTC in August 2016.

BBTC (M-cap 2925 cr)

Holds 50.75% stake (direct + indirect) in Britannia valued at 18000 cr

Also owns 14.35% stake in Bombay Dyeing— Varinder Bansal (@varinder_bansal) August 8, 2016

Varinder’s recommendation was also brilliant because BBTC has given a gain of 200%+ since then.

HUGE surge in BBTC @porinju

— Varinder Bansal (@varinder_bansal) January 30, 2017

Thank u @porinju sir for acknowledging my work on holding cos. BBTC still trades at 80% discount to Britannia where it holds over 50% stake

— Varinder Bansal (@varinder_bansal) January 27, 2017

Still remember @porinju sir mentioning in May 2015 about BBTC: BBTC @425 | perhaps the simplest stock idea!

— Varinder Bansal (@varinder_bansal) August 8, 2016

BBTC M-cap now 4000 cr

— Varinder Bansal (@varinder_bansal) September 7, 2016

BBTC covered on "Did You Know" when its m-cap was 1000 cr and now 5600 cr…..https://t.co/Xa3Qqpc8og

— Varinder Bansal (@varinder_bansal) March 6, 2017

Porinju prematurely encashed his gains

One of the ironical aspects of Porinju’s recommendations is that he himself does not get to reap the full benefits from the stock.

We have seen this earlier in the case of stocks like KRBL and Biocon which went to give massive gains after Porinju dumped them.

The same has played out in BBTC as well.

They did, lead by BBTC with 120% gain in 7 months! Am not holding now. https://t.co/caVcRQkHsB

— Porinju Veliyath (@porinju) September 15, 2017

After Porinju dumped the stock (presumably at Rs. 1200), it surged to an all-time high of Rs. 1823. Thereafter, it slumped to a low of Rs. 1132 in March 2018.

At the CMP of Rs. 1540, the stock is up a hefty 65% on a YoY basis.

Now Sunil Singhania recommends BBTC at Sohn India Conference

A few days ago, we saw the stocks recommended by Raamdeo Agrawal and Shankar Sharma at the famous Sohn India conference.

Sunil Singhania, the erstwhile fund manager with Reliance Mutual Fund and now the founder of Abakkus Asset Manager LLP, a PMS fund, was one of the dignitaries at the conference.

There is a good write up about his profile and multibagger stock picks by Ambit Capital.

Excellent report from Ambit on Sunil Singhania, worth reading

What a journey in stock market @SunilBSinghania @varinder_bansal @_anujsinghal pic.twitter.com/7TclQH2avU— Nimesh Shah (@nimeshscnbc) May 22, 2018

Sunil Singhania recommended BBTC as the ideal stock to ride piggyback on to take advantage of the prosperity of Britannia and Bombay Dyeing.

This was revealed by Varinder Bansal. He called it the “Best way to play Britannia”.

Good to see investment holding cos still getting noticed. Covered Summit Sec at 150 cr m-cap and lot of people told me that no value in holding cos – but fundamentals always win. No surprise why @SunilBSinghania sir pick was BBTC at @SohnConf. Best way to play Britannia https://t.co/QAEdaShxaF

— Varinder Bansal (@varinder_bansal) June 12, 2018

Sohm conference: the best recommendation made in last week's Sohn India Conference was stocks belonging to food & related categories. Jyothy Labs, Brittania, Parag Milk etc. Related idea was Bombay Burmah, which owns 51% stake in Brittania & 38% in Bombay Dyeing.

— Alok B Agarwal (@alokbagarwal1) June 10, 2018

BBTC is still grossly undervalued?

Apparently, BBTC is still grossly undervalued in the context of the market value of the assets held by it.

BBTC is presently quoting at a beggarly valuation of about Rs. 11,000 crore while the value of the Britannia shares held by it are itself worth more than 37,000 crore.

If one takes into account the value of the Bombay Dyeing shares and the other sundry assets in the Balance Sheet, it is obvious that we are staring at a deeply undervalued stock.

BRITANNIA at 6070

Stock Hits Yet Another Record High

MCAP at 73000 Cr

Also Watch for Bombay Burmah: Holds 50.7% Stake in Co

Bombay Burmah MCap at 10850 Cr

BBTC Holdings in Britannia worth 37000 Cr#FMCGisLife@CNBCTV18Live@BritanniaIndLtd https://t.co/fLRzk3hLcY— Mangalam Maloo (@blitzkreigm) June 13, 2018

BOMBAY BURMAH Mcap 6391cr

Holds 50.7% in BRITANNIA valued at Rs.25151cr

Stake in Britannia at 75% disc = MCap of Bombay burmah@CNBCTV18Live— Nigel D'Souza (@Nigel__DSouza) August 7, 2017

Is Summit Securities also a good buy?

Varinder Bansal explained the innards of Summit Securities in May 2014.

He pointed out that Summit Securities holds massive chunks of top-quality RPG Goenka companies like Ceat Ltd, Zensar, KEC International etc and that it was quoting at an unbelievable discount of 90% to its market value.

The market capitalisation of Summit Securities has since then surged from Rs. 150 crore to Rs. 900 crore, putting mammoth gains of 435% on the table.

Now, Nigel D’Souza of Mid-cap mania fame has picked up the gauntlet.

He has pointed out that Summit Securities is still quoting at rock-bottom valuations in relation to its underlying investments.

It's time for #MidcapMania & @Nigel__DSouza's pick for today is Summit Securities https://t.co/hPi8V4fUSR

— CNBC-TV18 (@CNBCTV18Live) June 11, 2018

Apparently, while the market capitalisation is only Rs. 850 crore, the value of the holdings is Rs. 4,500 crore, translating into a massive discount of 80%.

Today on #midcapmania we explain to u 'SUMMIT SECURITIES'

Which is the holding co of the Harsh Goenka cosMcap=850cr

Holding in various listed entities=4500cr

Has 40.83% in Spencer & Co ltd as well (not Spencer's Retail) https://t.co/ESNhYNRZlm— Nigel D'Souza (@Nigel__DSouza) June 11, 2018

Stel Holdings, Rane Holdings, are also undervalued wealth creators?

Stel Holdings, which is also a RPG Goenka company, is said to be undervalued according to Varinder Bansal and Nigel D’Souza.

Catch @Nigel__DSouza decode why STEL is bouncing in today's trading session @CNBCTV18Live pic.twitter.com/0QCAOzgTOH

— CNBC-TV18 News (@CNBCTV18News) August 28, 2017

Stel Holding in CESC valued more dan its MCap

STEL Holdings

*MCap Rs.152cr

*Holds 1.88% in CESC valued at 234cr— Nigel D'Souza (@Nigel__DSouza) August 28, 2017

A similar view has been expressed with respect to Rane Holdings, the holding company of Rane Madras, Rane Engine Valves and Rane Brake Lining etc. The stock has been a mega wealth creator and is likely to continue to do so in the foreseeable future.

Conclusion

Prima facie, the concept of buying holding companies and riding piggyback on the fortunes of operational companies is very appealing. In addition to the growth in the operational companies, if the discount narrows, massive gains will gush in. We need to study all the holding companies and tuck into the most undervalued ones ASAP!