After 100% gain in 2017, Mohnish Pabrai’s portfolio sinks 25% in H12018

Rupert Hargreaves of valuewalk has revealed top-secret details about the performance of Mohnish Pabrai’s Funds.

Mohnish Pabrai Has Rough Q2, Down 25% In H1 2018 : 2017 was a blowout year for Mohnish Pabrai‘s Pabrai Funds. After struggling to produce a positive return for investors between… – #MohnishPabrai #ValueInvesting – https://t.co/mLqwkm0JvB pic.twitter.com/nyQYLNjxDX

— ValueWalk (@valuewalk) July 12, 2018

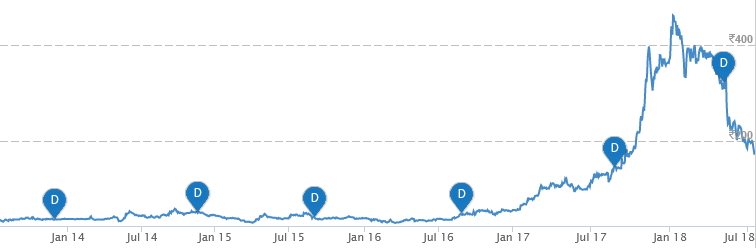

Apparently, Mohnish did not generate meaningful returns for his PMS clients from 2013 to 2016.

In fact, the returns were not positive.

However, he made up for this underperformance and delighted his clients in 2017 with a mind-boggling return.

While PIF 2 returned 92.2%, PIF 3 and PIF 4 returned 109.2% and 62.4% respectively.

The fate of PIF 1 is not known.

It is no secret that Rain Industries is the star of the portfolio.

According to Rupert Hargreaves, Rain Industries accounts for about 37%, 54% and 6% of assets of PIF2, PIF3 and PIF4 respectively as of 30th June 2018.

We have seen with our own eyes how Rain Industries effortlessly blossomed into a magnificent 12-bagger.

Mohnish first bought the stock in April 2015 at the throwaway price of Rs. 34.

Thereafter, the stock surged to an ATH of Rs. 475 in January 2018, giving mind-boggling gains of 1257%.

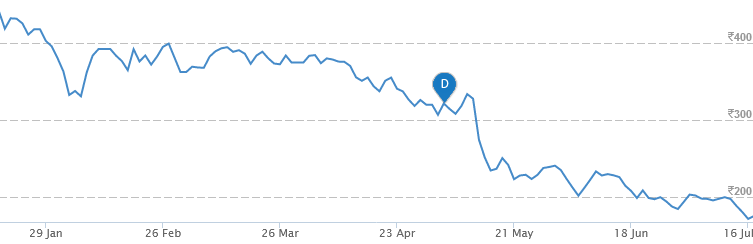

However, presently, the stock appears to be beset with unknown problems and has been sliding relentlessly. It is now resting at Rs. 174, down a whopping 63% from the ATH.

Thankfully, Mohnish still has a magnificent return of 400% since his first investment at Rs. 34.

Rain Industries is also the crown jewel of Dolly Khanna’s portfolio.

However, unlike Mohnish, Dolly has been quietly dumping the stock, sparking fears amongst cloners that the golden days of the stock may be behind it now.

Mutual Funds are also dumping the stock in an aggressive manner.

BULK DEAL

Rain Industries

BNP Paribas Arbitrage sold 18.90lk shares (0.6%) at Rs 277.43 each— Avinash Gorakshakar (@AvinashGoraksha) May 11, 2018

According to some market experts, the impending ban on pet coke is playing havoc with investors’ sentiments.

बहुत बढ़िया से धोया है SC ने?डंडे पे डंडे पड़ रहे हैं?

SC lashes out at Centre on pollution, questions delay in ban on import of petcoke“Let’s be clear abt something, people of this country are more important for us than anything,”SC lashed out at MOE https://t.co/wbTBK1N3iC

— Alka (@AlkaDewangan) July 18, 2018

Petcoke Ban Case | Centre tells Supreme Court that it supports ban on import of Petcoke. @PetroleumMin has submitted a report on use of various specifications of Petcoke pic.twitter.com/SBby2k41Hm

— CNBC-TV18 (@CNBCTV18Live) July 16, 2018

Some are also suspecting that Dolly Khanna may be dumping more of her vast holding though it is impossible to confirm this because Dolly is always tight-lipped about her investments.

(Six-month price chart of Rain Industries)

Latest portfolio of Mohnish Pabrai

This is an appropriate moment for us to peep into the latest portfolio of Mohnish Pabrai’s various funds and check their status:

| Stock | Nos of shares (Lk) |

Value (Cr) |

YoY Return (%) |

| Rain Industries | 328.84 | 572 | 39 |

| Sunteck Realty | 122.19 | 474 | 61 |

| Repco Home Finance |

37.19 | 215 | (24) |

| Kaveri Seed | 31.84 | 172 | (15) |

| Healthcare Global Enterprises |

39.91 | 111 | 8 |

| Kolte-Patil | 40.85 | 110 | 57 |

| CARE Ratings | 6.55 | 81 | (25) |

| Total AUM | 1735 |

As one can see Rain Industries is still the crown jewel of Mohnish Pabrai’s portfolio.

However, if it continues with its unabated fall, the day is not far when Sunteck Realty will snatch the crown from it and emerge as the top holding.

Repco Home Finance occupies third place in the portfolio.

Mohnish has given a detailed explanation on why the entire housing finance sector is a “no brainer” and why Repco has a “moat” which will enable it to outperform its competitors.

#ChaiWithPabrai | Repco Home has no competition in the demographic they're serving; Expect Repco's lending discipline to continue in the future, says @MohnishPabrai in an #Exclusive chat with @nikunjdalmia @tanvirgill2 pic.twitter.com/4Jr8w0HhpL

— ET NOW (@ETNOWlive) June 1, 2018

CARE Ratings is a sensible and fail-proof pick because of its high RoE, high dividend yield, high payout, debt-free status etc.

Rakesh Jhunjhunwala has described the entire credit rating sector as a “Halwa” business because of the high entry barriers, low cost of operation and high/ recurring fees. Customers have no option but to approach credit rating agencies every time they wish to raise equity or debt.

Balanced portfolio

It is evident that Mohnish has paid a lot of attention towards balancing the portfolio with stocks of different sectors.

He has stocks from the commodity/ infra sector, realty sector, finance, agriculture and healthcare in the portfolio.

(Mohnish with celebrity Chef Jiro in Japan)

What about Balaji Amines & Oriental Carbon Chemicals?

Mohnish held a chunk of 6,07,204 shares of Balaji Amines as of 30th September 2017. The stock is described as a “compelling buy” by leading experts.

However, the romance appears to have been short-lived. Mohnish’s name was not seen in any of the subsequent lists of shareholders.

Similarly, Mohnish had bought a chunk of 98,647 shares of Oriental Carbon as of 31st March 2017.

Mohnish had explained in one of his multifarious lectures that Oriental Carbon has a “moat” and a “monopoly” and that even if electric cars take over the World, the demand for tyres, and consequently sulphur, will continue unabated.

However, the stock does not appear to have caught his fancy beyond the initial token holding.

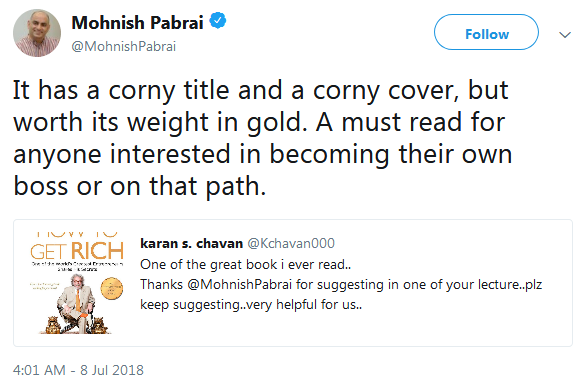

Latest recommendation – “worth its weight in gold”

Mohnish has recommended a book titled “How to Get Rich: One of the World’s Greatest Entrepreneurs Shares His Secrets” written by Felix Dennis.

He described the book as being “worth its weight in gold” and said that it is a “must read” for anyone interested in becoming their own boss or on that path.

Intellectuals who have read the book have praised it to the skies.

“I have read lots of other business books and none of them contain the truthful information you will get in this book. Felix Dennis has walked the walk and his teachings are from trial and error life experiences. Experience is the best teacher,” a reviewer gushed at amazon.com.

“This is an excellent book on the art of getting rich. I wish I had a book like this 15 years ago. It’s filled with timeless wisdom and some painfully obvious musings as well,” another added.

“One of the realest books ever written on making money in business,” yet another said.

Felix Dennis has written other books titled ‘How to Make Money: The 88 Steps to Get Rich’ and Find Success

and ‘88 The Narrow Road: A Brief Guide to the Getting of Money‘.

Conclusion

So far, we have not had much luck at “getting rich” from the stock market. Who knows, reading the book recommended by Mohnish Pabrai may change our luck and put us on the path to some riches at least!

care rating is also return proof

Glad that all the kachra stocks are being taken to the cleaners. And fake investors sucking up to their political masters thinking that this rally will last for ever are left licking their wounds. So good to see blood all around in the markets. Baap baap hota hai.

Indian Govt ultimately may have to think of environment and Pet Coke needs to be avoided. Real estate is unreliable sector with many Builders duped the investors and end users with large no of of unfinished projects. I doubt investors will now try to invest in residential properties, yes actual end users may continue buying but that only can not heat the sector with huge unsold and investors inventory lying vacant.