Dolly Khanna Storms Dalal Street

“Dolly Khanna aayi hai,” Mukeshbhai and Jigneshbhai screamed in unison as they barged into the RJ Fan Club.

I was preparing for my afternoon siesta at that time.

I had just had a sumptuous lunch of unlimited Gujarati Thali at Samrat coupled with a Punjabi Lassi at Kailash Mandir.

Naturally, I was feeling sluggish and drowsy.

“Dolly Khanna bulk deal kar rahi hai,” Jigneshbhai screamed in my ears while I struggled to shake the sleep from my eyes.

“Pehli baar Dolly bulk deal kar rahi hai,” Mukeshbhai also yelled, his eyes wild with excitement.

The three of us, tailed by a gaggle of local punters, rushed to the Sanctum Sanctorum at Jeejeebhoy Towers to see which stock had caught Dolly’s eye.

Unfortunately, security at Jeejeebhoy Towers was tightened. The entire area was cordoned off and no visitors were allowed.

The mandarins did not want Dolly to be pestered by riff-raff asking for stock tips.

Which stock did Dolly Khanna buy?

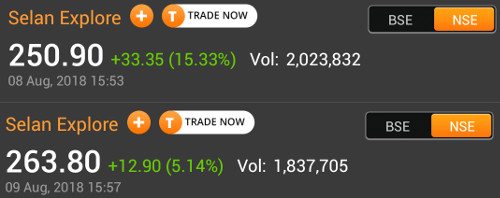

Thankfully, I have top-secret sources in Dalal Street who spilled the beans and revealed that Dolly had bought a massive consignment of 1,04,250 shares of Selan Exploration at Rs. 244 per share.

BULK DEAL ALERT:

DOLLY KHANNA bought 1,04,250 shares of Selan Exploration Technol at Rs. 244.03— Rohan Gala (@RohanG90) August 8, 2018

It is worth recalling that a few days ago, I had meticulously analyzed Dolly Khanna’s portfolio and sounded the red alert that Selan Exploration is her latest stock pick based on her holdings as of 30th June 2018.

Unfortunately, I myself did not understand the significance of my discovery.

“Prima facie, it appears that Selan Exploration is a low-conviction bet for Dolly,” I had observed with my usual naivety.

It is now obvious that Selan Exploration is in fact a high-conviction stock pick for Dolly.

| SELAN EXPLORATIONS TECHNOLOGY LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 409 | |

| EPS – TTM | (Rs) | [*S] | 13.20 |

| P/E RATIO | (X) | [*S] | 18.90 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 50.00 | |

| LATEST DIVIDEND DATE | 08 FEB 2018 | ||

| DIVIDEND YIELD | (%) | 1.90 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 179.51 |

| P/B RATIO | (Rs) | [*S] | 1.39 |

[*C] Consolidated [*S] Standalone

| SELAN EXPLORATIONS TECHNOLOGY LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | MAR 2018 | MAR 2017 | % CHG |

| NET SALES | 23.3 | 14.56 | 60.03 |

| OTHER INCOME | 1.79 | 1.99 | -10.05 |

| TOTAL INCOME | 25.09 | 16.55 | 51.6 |

| TOTAL EXPENSES | 13.21 | 13.42 | -1.56 |

| OPERATING PROFIT | 11.88 | 3.13 | 279.55 |

| NET PROFIT | 7.45 | 0.85 | 776.47 |

| EQUITY CAPITAL | 16.4 | 16.4 | – |

(Source: Business Standard)

Is Dolly sending us a message through the Bulk Deal?

Shyambhai, the wizened proprietor of Shyam’s Tea Stall at Dalal Street, propounded the theory that Dolly is trying to send her fans a subtle message by doing the Bulk Deal.

“Lagta hai Dollyji humko message de rahi hai ke stocks kharidneka time aa gaya hai,” he said between mouthfuls of Gutka.

Prima facie, there is merit in this theory because Dolly has never before been seen doing a Bulk Deal.

Her standard modus operandi is to buy and sell stocks stealthily.

The only time we learn of her activities is when the Companies file the quarterly disclosures with the stock exchanges.

So, it is possible that Dolly may have done a Bulk Deal so as to inspire us also to go out and buy high-quality stocks when they are going a-begging at bargain basement prices.

What is so special about Selan Exploration?

Selan Exploration is personally recommended by none other than Porinju Veliyath.

In 2012, Porinju had addressed a top-secret letter to the subscribers of his elite PMS Fund in which he revealed that Selan is the “largest holding in Portfolio”.

“Selan is priced at Rs.500 Cr today, against its estimated Oil reserves of over Rs.70,000 Cr in 5 proven oil fields spread across 200 Sq Kms in Gujarat! This debt-free, cash rich company has initiated an aggressive drilling program and is likely to grow at CAGR 50% for next many years. I find the management honest and very professional. Whatever happens in MENA or Europe, Selan should give us fabulous return in the future,” he had gushed.

Selan Exploration is up by 40% in a month. hold on tight…

— Porinju Veliyath (@porinju) September 27, 2012

Selan@275 is my best pick now! Got permission for a fresh batch of 6 wells at Bakrol. back on growth path after wasting 2 years!

— Porinju Veliyath (@porinju) March 4, 2013

Selan@250 underperformed due to drilling delays. surprised at price decline. I am confident on the stock and its fundamentals.

— Porinju Veliyath (@porinju) April 26, 2013

He also revealed that the holding of the PMS in Selan had crossed 5%.

Selan Exploration – Equity Intelligence's holding crossed 5%:http://t.co/txdMoQMeVZ

— Porinju Veliyath (@porinju) May 21, 2015

Later, in 2017, Porinju described Selan as a “beautiful company”.

“Selan is a beautiful company. It is sitting on Rs 130-140 crore cash and they have huge potential to expand more and more production and this kind of low oil price regime, it is making Rs 30-40 crore kind of cash flow. So the whole marketcap is around Rs 250-300 crore,” he explained.

Ashish Chugh had also come out with all guns blazing in favour of Selan as far back as in March 2010.

He reeled out impressive numbers and facts and made out a convincing case why Selan was a compelling buy at that time.

However, by and large, Selan Exploration has been a disappointment for Porinju and Ashish Chugh.

As the attached chart shows, barring a slight out-performance in 2014, the stock has been literally flat in the period from 2012 to date.

Selan is also an old favourite of Dolly Khanna

In June 2014, Dolly Khanna held a chunk of 307,969 shares of Selan Exploration.

However, she appears to have got fed up by the non-movement of the stock price.

By 01.04.2015, the holding was reduced to 182,773 shares. By 30.06.2015, she completely exited the stock.

What will change Selan’s fortunes?

It is obvious that Selan’s fortunes are directly dependent on crude oil prices.

However, the commentary by experts about crude oil prices is bearish.

In fact, Porinju himself predicted that crude oil prices will crash in 2019.

Oil price could go down by 12% in FY-19, I feel. https://t.co/jwnpK2HzRC

— Porinju Veliyath (@porinju) January 29, 2018

So far, this prediction is coming true if one goes by the talk of excess production and soft prices.

#commodities | Crude oil prices decline 3.5%overnight; US dollar firms Vs global peers. @Manisha3005 gives a round up of all the commodity & currency market pic.twitter.com/v4ZsMNdcyC

— CNBC-TV18 News (@CNBCTV18News) August 9, 2018

Crude oil benchmark Brent sees biggest one-day fall in two years https://t.co/gg98mrdjZh

— Reuters Business (@ReutersBiz) July 11, 2018

Conclusion

At this moment, we have to tread with caution. We have to closely monitor crude oil prices and production capacities. If the trend indicates that there is a glut of capacity and slump in prices, we stay away from Selan. However, if the data shows global shortage of crude and surging prices, we dive into the stock and rake in multibagger gains. This way, we can enjoy the best of both Worlds!

Porinju is punter ,has no understanding of macro economics.It is best to ignore him.

Rain Ind fortunes linked to alu industry which is looking weak.

sohail roshni

@sohail roshni

Expansion projects completed for rain industries.should add to revenue going forward.

http://equity-intelligence.com/admin/knowledgecenter/doc/SelanExplorationRs300_814975687.pdf

This is the link for poriju’s advise of 2009 and price at that time was Rs.300 and yesterday it was 248.

The problem is that until the oil starts flowing you are not sure, you really can’t judge how much there underground and how long it will last. Gujarat oil is not the light type and is highly viscous and it requires secondary treatment to get petrol or diesel kind of products from this type of crude. Price for such type of oil is less that lighter crude.

Hope somebody will not invest his hard earned money in this stock, because Dolly has put her money, and then repent.

One rule of thumb I follow–Never to buy any script when is being made enticing.