Few are aware that Rajiv Khanna, Dolly Khanna’s alter ego, is a qualified chemical engineer from the prestigious IIT Madras. Before starting his investment journey and raking in multibagger gains, Rajiv mastered the secrets relating to the chemicals industry by working as a “research associate” in a well-known company.

Rajiv and Dolly Khanna were amongst the first to realize that there would be a paradigm shift for the chemicals sector and that a lot of business would flow from China into India.

It is because of this visionary outlook that Dolly Khanna packed her portfolio with as many as four top-quality specialty chemicals stocks. These are Thirumalai Chemicals, Dai-Ichi Karkaria, NOCIL and Meghmani Organics.

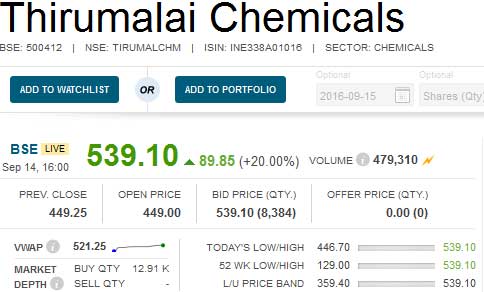

It is well known that the speciality chemical stocks have been on fire over the past several months and several of them have surged into orbit like rockets. On Wednesday, for instance, Thirumalai Chemicals led the charge with a magnificent surge of 20%. This was followed by another spectacular surge today.

Several other speciality chemical stocks like Sudarshan Chemicals, Chemfab Alkali, Pondy Oxides, Mysore Petro, Jyoti Resins, IG Petro, Bodal Dyechem, Akshar Chem, Kiri Industries etc have also notched up impressive three digit gains on a YoY basis.

Dolly Khanna’s gains from the speciality chemicals stocks in her portfolio are as follows:

| Specialty Chemical Stocks In Dolly Khanna Portfolio | |||||

| Stock | Nos of shares | CMP (Rs) | Value (Rs Cr) | YoY Return (%) | Two Year Return (%) |

| Thirumalai Chemicals | 132173 | 544 | 7.19 | 150 | 365 |

| Dai-Ichi Karkaria | 86647 | 579 | 5.01 | 49 | 318 |

| NOCIL | 2180801 | 66 | 14.39 | 53 | 58 |

| Meghmani Organics | 6,58,492 | 40 | 2.63 | 123 | 153 |

Thirumalai Chemicals

Thirumalai Chemicals Ltd, the crown jewel in Dolly Khanna’s portfolio, is said to be the largest manufacturer of Pthalic Anhydride in India and the third largest manufacturer in the world. The Company was set up in 1976 and has a production capacity of 1,80,000 tonnes. It manufactures a vast product range of industrial and specialty chemicals catering to the plastics, paints and colorants industry. Thirumalai Chemicals is said to be the first among all chemical companies in India to get certified by ISO 9001 as far back as in 1994.

Anil Kumar Goel and Seema Goel are also major shareholders in Thirumalai Chemicals. Their collective holding of 556,000 shares surpasses that of Dolly Khanna and is worth Rs. 30.20 crore.

Dai-Ichi Karkaria

Dai-Ichi Karkaria is such a low profile company that few have heard of it and there is no literature available on the Company. How Dolly Khanna stumbled on this company is a big mystery. The Company is said to be engaged in manufacturing specialty chemicals which are used in the Oil field sector, the Rayon industry and the Paint industry.

Dolly Khanna held 78,221 shares as of 1st April 2015 and increased it to 86,647 shares as of 31st March 2016 where it has remained as of 30th June 2016.

NOCIL

The aggressive manner in which Dolly Khanna has scaled up her holdings in NOCIL is sending the clear signal that she is ultra bullish about the prospects of this Company.

As of 1st April 2015, Dolly Khanna held a mere 6,19,131 shares of NOCIL. She has scaled it up to 21,80,801 shares as of 31st March 2016 where it stands as of 30th June 2016.

As of 31st March 2016, Madhuri Kela (related to Madhusudan Kela of Reliance Capital fame) held 10,00,000 shares while Nirmal Bang Financial Services Pvt. Ltd held 11,40,000 shares. Edelweiss Securities held 6,24,576 shares.

NOCIL is engaged in the manufacture of “rubber chemicals” and is said to be the largest manufacturer in India.

DD Sharma, the veteran stock market expert, recommended a buy of NOCIL on the basis that as the automobile tyre industry grows, so would the demand for NOCIL’s products.

Meghmani Organics

Meghmani Organics is familiar to us because Daljeet Kohli had famously declared it as a “classic turnaround story”. Daljeet was right in his recommendation because Meghmani shot up from Rs. 15 to Rs. 49.75, giving impressive multibagger gains to Daljeet’s followers. The stock is presently resting at Rs. 40.

Dolly has aggressively increased her holding in Meghmani Organics as well. She held 4,54,475 shares as of 1st April 2015 which is increased to 6,58,492 shares as of 31st March 2016. The holding as of 30th June 2016 is not known.

Indianivesh Capitals Limited, Daljeet Kohli’s company, has bought 6,86,000 shares as of 31st March 2016.

Huge growth expected in the specialty chemicals sector

Experts have opined that the projected growth of 7.6% in the Indian economy will be consumption driven and result in a surge of consumption for Specialty Chemicals. It is predicted that the Specialty Chemical market which is currently USD 30 Billion will grow to a level of USD 80 Billion by 2023. With growth estimates of 14% CAGR the Specialty Chemical industry is expected to grow much faster than India’s GDP. The vast potential for growth for the finished products from the chemical sector can be envisaged by comparing the per capita consumption of these products against world averages. Compared to developed markets the usage of Specialty Chemicals in India is fairly low.

It is also stated that most Specialty Chemical companies in India have asserted their domestic presence by designing and developing products that are very specific to the performance needs of an industrial application for a particular customer/ customers.

Shankar Sharma is also bullish about the specialty chemicals sector

Shankar Sharma has opined that the boom in the speciality chemicals sector is likely to continue in the foreseeable future as well. In his latest interview to ET, Shankar said that the China versus India play is a big, big trend shift because Indian companies are competing and collaborating with China. He added that the Chinese behemoths are likely to outsource to Indian companies or set up contract manufacturing facilities in India.

Shankar also confidently asserted that the speciality chemicals space is still a good one and still has a long way to go.

Shankar Sharma has recommended Kiri Industries as his personal favourite speciality chemical stock. Kiri is up 280% on a YoY basis.

Ravi Dharamshi of ValueQuest Investment Advisors Recommends Specialty Chemical Stocks

Ravi Dharamshi of ValueQuest Investment Advisors pointed out that the global chemical industry stands at $4.5 trillion and that it is growing at a CAGR of 15%. India has about 3% market share which is expected to increase to 4.5% market share in five years. The companies can easily grow at the rate of 15% to 20% over the next 5-10 years. It is a huge good growth rate and a long run way that these companies have. And it does not matter what happens to the global liquidity flows, this trend is going to play out.

He opined that specialty chemical stocks engaged in dyes and pigments, Agrochem, fragrance and flavours, surfactants, personal toiletries and other niche areas will do well.

While Ravi Dharamshi did not name any stocks, it is obvious that he is referring to PI Industries (agrochem), Kiri Industries, Camlin Fine, Vidhi Dyestuffs (dyes and food additives), SH Kelkar (fragrance and flavours), Sudarshan Chemicals (chemicals) etc.

View endorsed by Manish P Kiri

This proposition is endorsed by Manish P Kiri, MD, Kiri Industries. He pointed out that China is changing the dynamics globally in terms of specialty chemical supplies and that Indian specialty chemical manufacturers are the biggest beneficiaries of this change.

Conclusion

Novice investors like you and me have so far been mute spectators. We have not taken the cues generously offered to us by Dolly Khanna in the past. Fortunately, it is not too late because Shankar Sharma and Ravi Dharmashi have advised that the party is just starting and that it has a long, long way to go. So, we have to grab our own favourite stocks from the specialty chemicals sector and prepare for the long ride. However, given that we have no expertise of our own, it is best if we stick to the stocks invested in/ recommended by wizards such as Dolly Khanna (Thirumalai Chemicals, Dai-Ichi Karkaria, NOCIL, Meghmani Organics), Vijay Kedia (Sudarshan Chemicals, Apcotex Industries), Shankar Sharma (Kiri Industries), Ashish Kacholia/ Rahul Saraogi (Navin Fluorine), Microsec (Ultramarine Pigments) etc and not go on an exploratory mission of our own!

Another contender forgot to be mentioned is Shree Pushkar chemicals and fertilizer Company Limited. It purports to be zero waste company and thereby command higher PE than peers. The only reason it’s not visible because it’s a new company and not appearing in screening parameters etc

Shamoli

Shree Pushkar Chemicals is really flying like anything. It has zoomed up by 55% since you mentioned it here. 🙂

Big fan sir of ur website. Keep on giving such great advise.

Stocks that do not attract the fancy of big investors may require unnerving patience and hence may not move as expected . Even they take so long a time that retail investors finally give up .

What is your opinion on Fineotex chemicals Ltd ?

Thanks

So everybody is bullish on Chemical sector… even the specialists who have not been named here in the column.

Story may continue till some environmentalist and public don’t move to state high courts, Supreme Court, Central pollution control board and state control board with environmental issues. Chemical industry has been thrown out of devopled world due to pollution and even China has Crack down. Now just make money till Crack down in India start as after full compliance it becomes costly afair to compete and chemical industry shift to next non complient and unignorent country. But definitely no issues to those who are well complient but they will be few.

Cosmo Films. Dolly Khanna just ramped up her stake in it. Check Annual report. Holds 0.75% stake.

Specialty BOPP film manufacturer – gonna fly!

ashish kacholia buys vivimed labs in bulk deal

Hi mr Desai than what you feel should we BUY ITand what’s your detailed analysis and targets , and anything else you like as off now,waiting for helpful answer ,

MR JASPAL VIVIMED LAB HAS COME OUT WITH LAST QUARTER EPS OF RS 3.44 THEY HAVE SPECIALITY CHEMICAL DIVISION A PART OF WHICH THEY HAVE SOLD TO CLARIANT CHEMICALS FOR MORE THEN 300 CR OUT OF THAT RS 140 CR WAS PAID TO RETIRE DEBT DUE TO WHICH IN THE LAST QUARTER INTREST COST HAS COME DOWN FROM RS 24 CR TO 15.R CR THEY ALSO HAVE 4 US FDA APPROVED FACILITY GOING FORWARD THE SALES WILL BE IN THE RATIO OF 80:20 IN FAVOUR OF PAHARMA AND CHEMICAL DIVISION COMPANY HAS MANY TRIGGERS PLASE READ LATEST ANNUAL REPORTFOR FURTHER INFORMATION THIS IS THE CHEAPEST PHARMA STOCK AVILABLE INFO DISCLOUSER INVESTED

Mr Desai thanks for a prompt reply and I hope this will help all readers to identify multi baggers , will like to have your views on nocil as it’s also a chemical player and Vishnu chemicals though last quarter was tough for them , I have to buy them but still thinking to go with which one , As here in Chandigarh there talks in air , jaspal

Hi rajul can you share Going forward what we should add on and which stocks you feel can become stars from here , waiting for your reply , thanks Chetan