Low valuations + high earnings = multibaggers

It is an elementary principle of the stock market that a stock showing hefty earnings but whose price has slumped owing to extraneous reasons is a certified multibagger and we have to grab it with both hands.

Shankar Sharma called this simple principle his “investing mantra”:

Investing Mantra: "Unleveraged balance sheet+intact earnings growth+stock price down 30%+ = Great Buying Opportunity": Shankar Sharma, 1973

— Shankar Sharma (@1shankarsharma) March 8, 2018

These moments keep happening so regularly in markets: you get your favourite stocks 30 percent lower, in days. With nothing having changed in their outlook. Love such situations ?

— Shankar Sharma (@1shankarsharma) February 5, 2018

Basant Maheshwari also endorsed this principle.

“The time to make money from stocks backed by earnings is NOW,” he said in pithy words.

I can talk only of the bull & not the duck.Have been saying since January that it’s“Khela Khatam Paisa Hajam” for the general mkt.But the time to make money from stocks backed by earnings is NOW, when the overall market collapses earnings get scarce & scarcity drives the premium. https://t.co/oIib28UwZJ

— Basant Maheshwari (@BMTheEquityDesk) June 2, 2018

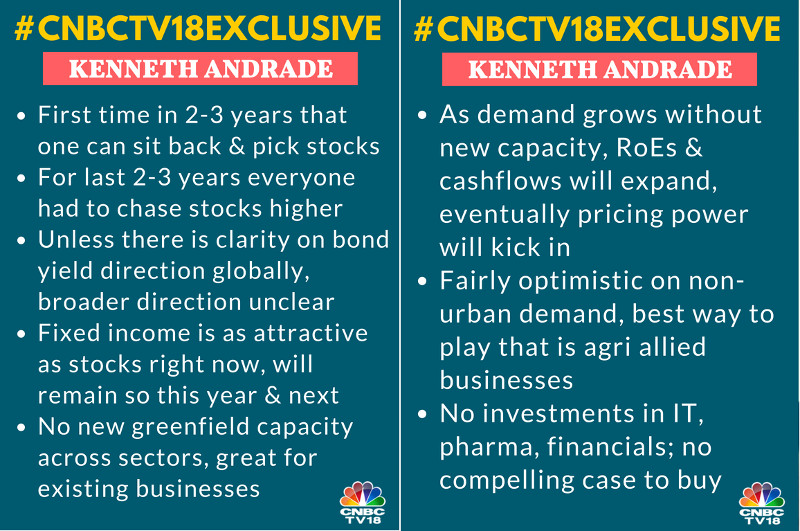

Kenneth Andrade has said the same thing, albeit in a long-drawn manner:

“The environment for investing is extremely good … This is a market that works for long-term investors,” he said.

“There are a large number of companies that are hitting 52-week lows and some of them are hitting all-time lows,” he added, implying that valuations have plunged.

“A big part of that balance sheet clean up is already over. The amount of cash that is getting generated in the individual balance sheets are far higher than what was seen in the last couple of years,” he opined, implying that the earnings are surging.

A combination of low valuations and high earnings means that building a portfolio is child’s play.

“I am sure if you get a portfolio together this year, the next couple of years should not be such an issue in terms of generating incremental returns,” Kenneth added with a big smile on his face.

Midcaps and smallcaps are bottoming out

Kenneth explained that there two elements which are signaling that a large part of the selling is done.

First, the liquidity is coming into the cycle in the form of significant capital gushing into mutual funds.

Second, profitability or earnings are stabilizing in FY2018 and FY19-20.

He pointed out that even if profitability goes up by only 5% or 6%, which is equivalent to GDP growth, the return on equity (RoE) and return on capital employed (RoCE) shoots up, making stocks irresistible.

“All the companies that you are talking about, whether they are largecaps, midcaps or even smallcaps, the incremental capital efficiency is going to remain so elevated that a lot of these companies will command a premium in the environment,” Kenneth said.

“I am not too worried about quality businesses or good companies out there, going lower in terms of price earnings multiple. I want their profitability to bounce back significantly over the next four-year period,” he added.

Time is ripe to buy rural/ agriculture stocks

Kenneth Andrade recommended that we buy Coromandel International at the famous Sohn India 2016 Conference.

The recommendation was brilliant because Coromandel International is up nearly 100% over the past 24 months.

Also, it is a blue-chip and fail-safe stock with impeccable credentials of the Murugappa group.

“It has been just about two years since the rural theme has been in play and that trend continues,” Kenneth said.

He also pointed out that the valuations have normalised in 2018, which is a good point.

“From an industry standpoint, there is no fresh capacity that has come into the system in any of those verticals that are there,” he added.

He further explained that we have to look for sectors where supply is a constraint and demand is growing.

“Look for where the supply constraints are and if demand is growing faster than supply over the medium term, that is where the industry has pricing power,” he emphasized.

It is elementary that huge demand coupled with low supply will translate into hefty earnings which will in turn lead to multibagger gains.

Which rural/ agri stocks are ripe to buy now?

GNFC appears to be a good candidate because it is a monopoly producer of specialty chemicals like TDI and Acetic Acid.

It is also one of the favourite stocks in Dolly Khanna’s portfolio.

I have explained all the salient points of GNFC at the time that Dolly first bought it.

In fact, GNFC has given a spectacular gain of 248% over 24 months and 58% over 12 months.

Keep an eye on @GNFCLTD

China acetic acid soars to highest in a decade on tight supply

GNFC is the only manufacturer of Acetic Acid in IndiaHowever TDI prices will continue to take centre stage

Sheela Foam had expected prices to correct frm current levels (Rs.295/kg) https://t.co/3mWbmaWwmB— Nigel D'Souza (@Nigel__DSouza) May 28, 2018

Yet another sensible way to play the agri theme is by tucking into stocks that make so-called “value addition” and rake in hefty gains.

Mohnish Pabrai has recently bought truckloads of two such stocks, being KRBL (basmati rice) and Kaveri Seed (genetic seeds).

Dolly Khanna has put her trust on LT Foods (Dawaat basmati), which is an arch rival of KRBL.

Billionaire Satpal Khattar is backing Nath Bio-Genes (genetic seeds) which according to Mudar Patherya “is on the cusp of unprecedented opportunities”.

Even Dairy stocks like Parag Dairy, Heritage Foods etc which sell milk products like cheese, butter, dahi etc as ‘FMCG products’ are good buys now according to leading experts.

Softening of stance regarding Pharma stocks

Kenneth appears to have changed his mind regarding the prospects of Pharma stocks.

In an earlier piece, he had come out with all guns blazing in favour of Pharma stocks.

“In pharma, there is a lot of investment that has gone into the ground. There is a lot of investment. Over the next year or two, if you can get all that investment that has gone into ground at a price, it answers your case. Here I would just like to say you should continue to buy into cheap valuations till that inflection point when growth actually starts coming back,” he had said.

However, the poor show of the Pharma stocks on the operational front has rightly dampened his enthusiasm for these stocks.

He offered theoretical advice that we have to look for leaders in the sector.

“The first thing to look for is leadership in the entire industry losing profitability. When that happens, usually the bottom end of the entire market or the bottom end of that industry bombs out and no new incremental capacity comes on board. You are mid-way through that down cycle as far as the pharma business is concerned.”

Obviously, this sort of abstract advice without specific stock names is not very useful to us.

He did, however, clarify that he has “not initiated any trade in that sector as of now,” which means that there is no point in our being adventurous and tucking into Pharma stocks.

He also added that there is “no compelling case” for investment in Pharma stocks.

Assuming we are adamant about investing in Pharma stocks, Aurobindo Pharma appears to be a good bet because according to experts it is quoting at “rock bottom valuations” and the risk of further downside is low.

Hot Money | Aurobindo Pharma gets thumbs-up from experts despite muted Q4.@darshanvmehta1

Watch the full show: https://t.co/ZwVvcU7crh pic.twitter.com/lET1DfX03c

— BloombergQuint (@BloombergQuint) May 31, 2018

DB on Aurobindo Pharma: Minor blip, biz outlook remains +ve

Maintain Buy, TP revised to Rs 728 from Rs 849

Trading at an attractive PERof c.14x FY19E (a disc of more than 30% to Indian peers

Believe risk-reward appears favorable @ekta_batra @CNBCTV18News— Nimesh Shah (@nimeshscnbc) May 30, 2018

Latest stock picks

Kenneth Andrade’s latest stock pick is a small-cap (Rs. 2300 crore) company named Hathway Cable and Datacom Ltd.

On 19th April 2018, his Old Bridge Capital PMS Fund bought 164,58,492 shares at Rs. 39.50 each.

A sum of Rs. 65 crore has been invested in the stock.

The timing of the purchase was not auspicious because the stock has plunged to Rs. 27.60 causing a hefty loss of 30%.

Anyway, the logic for the purchase of Hathway Cable is explained by Kenneth Andrade as follows:

(i) The business is at an inflection point where profitability will be ahead of the capital deployment;

(ii) The capital intensity of the business is not going to go away but incremental number of subscribers that will come on book are going to be reasonably slower than what you have seen in the past;

(iii) A lot of the build-up of the debt works have already taken place;

(iv) A large part of the networks are already built and most of these companies and most of the assets are already positioned in terms of monetising them over the next two or three years with new streams of revenue and new streams of business opportunities.

(v) From a price point and from a replacement cycle also, the company is trading at virtually replacement cost;

(vi) That is what we like about any business which we touch and this is one business that fits the requirements;

(vii) As the whole environment is stressed, one cannot get hypercompetitive which means in the medium term, you will have some incremental pricing power. All of that will go to the bottom line that is as far as the income statements are concerned.

(viii) On the balance sheet side, you have already seen a large part of the investment already in play. So, balance sheet growth will not be as high as you have seen in the past.

(ix) These are two variables that we look for in any of the categories that we invest in and that is how we put most of our money to work.

Stock to be in focus Tommrw

HATHWAY

Old Bridge capital bought 1.65cr shares today

Old bride capital is owned by Kenneth Andrade

Marquee investors lining up it seems fr Hathway

*In past quarter Akash Bhanshali name appeared in the 1%+ holding https://t.co/o5bi0cMsFV— Nigel D'Souza (@Nigel__DSouza) April 19, 2018

What about the investment in SME stocks?

Kenneth Andrade has also developed a liking for SME stocks and is buying them aggressively.

A few days ago, he bought a SME named ‘MMP Industries’ which is engaged in manufacturing aluminum products.

Stock focus:

MMP Industries (in NSE SME exchange)

Got listed at 190, now at 211

In biz pf Aluminium powders and paste, used in construction, mining, agri

Kenneth Andrade's Old Bridge Capital bought 1.6% stake— Mubina Kapasi (@MubinaKapasi) April 16, 2018

Nickey Mirchandani of Bloomberg has explained the merits of MMP Industries and why it attracted Kenneth Andrade.

Kenneth Andrade bought over 1% stake in the year's largest SME IPO which got listed on NSE on April 11. We spoke to the management to find their future business outlook. Listen In. https://t.co/cPcU3qoGob

— nickey (@OnlyNickey) April 13, 2018

Kenneth Andrade's old Bridge capital management – all cap fund buys 2.15lakh shares of mmp industries at 193 today.. He totally holds closer to 13lakh shares in mmp industries now.. Resoinneur capital is the another anchor investor holding mmp inds..

— Shreenidhi P (@nid_rockz) April 12, 2018

He has also bought a chunk of another SME named MacPower CNC according to Varinder Bansal, an authority on SME stocks.

MacPower CNC SME IPO – Old Bridge Capital’s Vantage Equity Fund managed by Kenneth Andrade subscribes to entire anchor book of 9.99 crore. @pantomath_group

— Varinder Bansal (@varinder_bansal) March 10, 2018

Varinder Bansal has pointed out that a number of eminent luminaries like Ramesh Damani, Madhu Kela, Porinju Veliyath, Vijay Mohan, Sunil Singhania etc have tucked into SME stocks.

Who invested in SME IPOs?

Ramesh Damani – Vadivarhe Speciality

Madhu Kela – Iris Business Services

Porinju – RM Drip Irrigation

Goldman Sachs India Head Vijay Mohan – RKEC

Sunil Singhania – ANI Integrated

Yes Bank, HSBC Midcap Fund, Jaspal Bindra – One Point One Solutions https://t.co/FSjy73GmNS— Varinder Bansal (@varinder_bansal) December 14, 2017

Some interesting name in SME IPOs

HSBC MF invested in Worth Peripherals

DSP Black Rock MF invested in Momai Apparels

Kuber Fund, Elara invested in Bohra Ind, Lexus Granito https://t.co/ki2nSlmQ9J— Varinder Bansal (@varinder_bansal) December 14, 2017

SME #stocks soar as top funds, investors start buying https://t.co/JmpCRfzlgR pic.twitter.com/r39hb6ltla

— ETMarkets (@ETMarkets) May 9, 2018

He also opined that SME stocks are “where mid & small-cap stocks were in 2000,” implying that incalculable wealth can be harvested from them if we have the patience.

Today – SMEs are where mid & small-cap stocks were in 2000. Change did happen and change will continue with SME investing for long term wealth creation. pic.twitter.com/Ys7eZHnQYQ

— Varinder Bansal (@varinder_bansal) May 22, 2018

However, given their turbulent nature, some experts have warned novices to “totally avoid large exposure in small caps and SME stocks”.

Keep an eye on this stat. Number of stocks hitting 52 week low vs 52 week high. Also retail must totally avoid large exposure in small caps and SME stocks etc there may not be exit in many of them. https://t.co/6P9LCL6Z4p

— Anuj Singhal (@_anujsinghal) May 16, 2018

SME stocks are too fragile..

A quarter is Enof for profits & losses to swing like a pendulum

Sometimes lightest doubt can collapse the house of cards

What went wrong with

Majestic Research ?— Abhay (@Horizon_Abhay) June 1, 2018

Conclusion

It is obvious that there is a gold mine waiting for us if we get our cards right. We can also consider taking baby steps into SME stocks after thorough research into their fundamentals. If these stocks are indeed where small and mid-cap stocks were in 2000, there is no justification for our staying aloof from them!