Respect local Gurus

It is no secret that the intellectuals on Dalal Street have a fascination for foreign Gurus.

One can see them making extensive reference to quotes from Warren Buffett, Charlie Munger, Peter Lynch etc.

However, they studiously ignore the local Gurus like Rakesh Jhunjhunwala and Radhakishan Damani even though the achievement of these Billionaire luminaries is as good as, if not better than, the achievements of the foreign Gurus.

Naturally, this sorry state of affairs has not escaped the attention of Mohnish Pabrai, a Guru in his own right.

In his latest interview, Mohnish gently admonished the intellectuals and hinted that they should give due regard to the achievements of the local Gurus as well.

He sent the unmistakable hint that we should follow Rakesh Jhunjhunwala’s illustrious footsteps.

Rakesh Jhunjhunwala, the ultimate buy and hold investor

Actually, we cannot blame the intellectuals because, unlike Warren Buffett and Charlie Munger, Rakesh Jhunjhunwala is a bit of a swashbuckler.

He is a trader first and loves to trade as fast as he talks.

However, Mohnish clarified that the Badshah is actually a text-book example of a buy-n-hold investor just like Warren Buffett and Charlie Munger are.

“Rakesh Jhunjhunwala has this persona of a guy who sits in front of three screens, talking to people all the time and all this activity is going on. But then in his portfolio, Titan doesn’t get touched for decades. Lupin doesn’t get touched. The crown jewels don’t get played with,” Mohnish said, the admiration clearly evident in his tone.

Carl Icahn, also a swashbuckling buy-n-hold investor

Carl Icahn, like Rakesh Jhunjhunwala, has the persona of a swashbuckling trader.

However, he baffled everyone by revealing that the “real secret” behind his stupendous success in the stock market is the fact that he has held on to stocks for decades.

“I was surprised myself about the long-termism that we do” Carl said, pulling out a paper from his pocket to answer a question on whether he believes in long-term investment.

“ACF, I hold 31 years …. I hate to admit that I hold these stocks for this long … American Rail Car Industries, 23 years, PSC Metal, 17 years, Federal Mogul, 14 years, Viscase, 14 years, Accel, 14 years….”

“It goes on and on” he said.

“The real money that I made over the years is holding companies for 7, 8, 9 years and keeping them ….. You got to buy them when nobody wants them really …. That’s the real secret …. It sounds very simple but it is very hard to do … when everybody hates it, you buy them … and then when everybody wants it, you sell it to them … And that’s what we do” Carl explained.

I am a ‘shameless cloner’, 45% of my portfolio is based on cloned stocks

One aspect about Mohnish Pabrai that is refreshing is his candid admission that he indulges in cloning other people’s stock picks.

This is surprising because it is not only the intellectuals but even the novices are loath to admit that they copied somebody else’s stock ideas.

“Cloning is very good for your financial health. There are lots of smart people in the investment world and it is very much worth looking at what their highest conviction bets are,” Mohnish said.

“Cloning is a very powerful concept. Cloning also embeds in it one of the things that I found with humans which is very peculiar is humans have difficulty with cloning. Maybe it is ego,” he added.

Mohnish also made the surprising revelation that the two largest holdings in his portfolio, namely, Fiat Chrysler and Rain Industries, are based on somebody else’s recommendation.

“I couldn’t have invested in Rain based on the brain power given to me by God,” Mohnish said with utmost humility.

“In our portfolio, 45% is just these two stocks which are coming from cloning,” he revealed.

@harshaspoint I am not capable of such wisdom. I am just a shameless cloner. It's from the Upanishads:

You are what your deep, driving desire is

As your desire is, so is your will

As your will is, so is your deed

As your deed is, so is your destiny

(Brihadaranyaka Upanishad)— Mohnish Pabrai (@MohnishPabrai) September 3, 2018

However, at this stage, we must remember that Mohnish has sternly warned us not to indulge in blind cloning.

He pointed out that he would never buy a stock “even if Warren Buffett recommended it” without first doing his own “intense drill down” homework.

Never buy a stock without doing your own thorough research. I'd never buy a stock even if Buffett recommended it to me without doing the wrk https://t.co/Ed6vDTnkh8

— Mohnish Pabrai (@MohnishPabrai) November 5, 2017

It is a starting point to begin an intense drill down. I use other people's ideas as a starting point for intense research. https://t.co/b0H94r79st

— Mohnish Pabrai (@MohnishPabrai) November 5, 2017

Exactly! https://t.co/qLKiIfadKI

— Mohnish Pabrai (@MohnishPabrai) November 5, 2017

(Mohnish Pabrai with Raamdeo Agarwal and other dignitaries)

Mohnish hikes stake in “no brainer” stocks

I diligently reported earlier that Mohnish had bought a chunk of Care Ratings, a credit rating agency.

Large Trade

CARE RATINGS@MohnishPabrai's fund "Dhandho India Zero Fee Fund Offshore Ltd" Buys 2.04 lk shares (0.7%) at 1188/sh

@CNBCTV18Live— Mangalam Maloo (@blitzkreigm) June 26, 2018

I explained the entire merits of the stock and also pointed out that Rakesh Jhunjhunwala regards the entire credit rating sector as a “Halwa” business owing to the high entry barriers, the duopoly structure and the ease with which clients flock.

Now, the latest news is that Mohnish has added more of Care Ratings to his portfolio and taken his holding to a mammoth 7%.

Mohnish pabrai of pabrai investment brought 713290 share of care ratings brought his stake to 7%.

— Avinash Gorakshakar (@AvinashGoraksha) August 31, 2018

? CARE RATINGS ?

Price: ₹1307

MarketCap: 3850 Cr

ROCE: 65% ?

ROE: 25%

P/B: 6

P/E: 25

DEBT/EQ: Negative ?

EV/EBITDA: 18 ?

Dividend yield: 1.84% ?No promoters. Only FIIs, DIIs

My guru @MohnishPabrai increased stake to 7.5%. ?

Need any more info friends? ? pic.twitter.com/mMHV8Rc18T— Ramesh Veerabhadra (@RameshVeerabha9) September 1, 2018

I also reported that Mohnish has recently bought a stock with a “unique business model”.

Invest In 'No Brainer Stocks' For Multibagger Gains Says Mohnish Pabrai While Buying Stock With 'Unique Business Model' https://t.co/zSN1yUzX90 pic.twitter.com/Jd6Gxq5tss

— RJ Stocks (@RakJhun) August 14, 2018

Latest recommendation of Mohnish Pabrai – ‘Financial Shenanigans’ and ‘The Grid’

Prima facie, it appears that Mohnish is making a subtle attempt to intellectualize novices by recommending books.

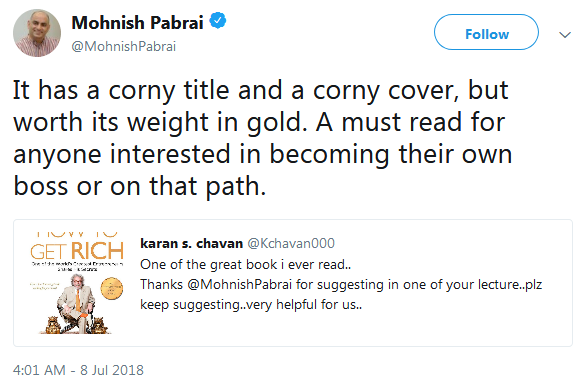

On an earlier occasion, Mohnish recommended that we educate ourselves by reading a book named “How to Get Rich: One of the World’s Greatest Entrepreneurs Shares His Secrets”.

Mohnish assured that the book is “worth its weight in Gold”.

On this occasion, Mohnish has recommended two books, one named ‘The Grid’, which was in turn recommended to him by Billionaire Bill Gates, and the other named ‘Financial Shenanigans’.

I conducted immediate research into both books at amazon.in.

As expected, both books have met with rich praise from the intelligentsia.

Marc A. Siegel, board member of the Financial Accounting Standards Board (FASB), described ‘Financial Shenanigans’ as a “must read“.

“The authors teach forensic financial statement analysis in an easy-to-digest format with lots of war stories. Guaranteed to help investors in their quest to avoid ticking time bombs in their portfolios,” he said.

Joel Greenblatt, the well-known investor and partner of Gotham Asset Management, stated that “Though Accounting is surely the language of business, Howard is the master of teaching investors how to read between the lines”.

“It’s so much easier to be a good investor if you can avoid problems. This book is required reading for all investors who wish to enhance their forensic intuition. Howard, Jeremy and Yoni use excellent and powerful vignettes to illustrate how to detect accounting trickery and financial deception,” Philippe Laffont, Founder, Coatue Management opined.

We cannot avoid reading ‘The Grid’ under any circumstances because it has been personally recommended by none other than Bill Gates.

“This ground-breaking book from award-winning author Matt Watkinson reveals the fundamental, inseparable elements behind the success of every business,” it is stated.

The book is also claimed to provide “mental scaffolding” to help us evaluate and refine product and service ideas.

Great thoughts and learnings from Monish.

I agree one should have core long term holdings. I find it amusing when TV channels and Advisor come with weekly or daily podcast on what happened this week and what do.

With three decades of experience with many small initial set backs, I have just learn one thing, just go for Top Quality Stocks which are either leader of sector or you can go for no 2 or 3 of a big sector also if they are showing more growth than leader,growth in revenue and profit should be atleast double digit CAGR , if possible preferably around 15% or more. Just buy such companies across various sectors like SIP mode and keep on shunting out where growth slow down for long term and keep on adding new players in new emerging sectors with similar fundamental as discussed above. No recommendation but for discussion.

Very Interesting Kharb.Which do you think are the emerging sectors now.

Sectors don’t emerge so fast but for example, pvt insurance listing and AMC listing of mutual funds were new listed sectors, over priced, but still deserve investment in SIP mode slowly for long term portfolio. No recommendation but for discussion.

Thanks Kharb will keep an eye on these sectors .Means a lot coming from you.