Porinju gave green signal to buy “chor” stocks, novices went on rampage & bought “junkyard” stocks

In hindsight, Porinju ought to have known better than to give novices the liberty to buy stocks on their own.

Novices have to be kept on a tight leash and given strict instructions on what they can and cannot buy. Left to themselves, novices invariably land up in trouble and extricating them from it is a Herculean task.

We can see the catastrophic consequences already.

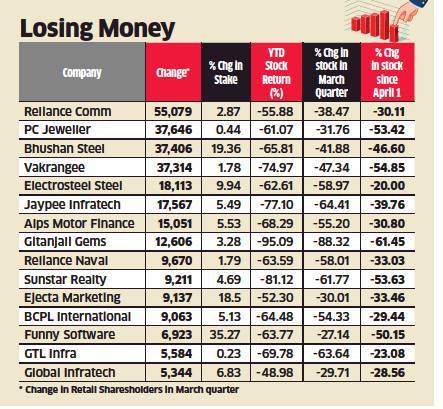

According to an investigation conducted by the sleuths of ET, novices have indiscriminately loaded up on junkyard stocks like PC Jeweller, Vakrangee, Gitanjali Gems, Punjab National Bank, Reliance Communications, Bhushan Steel, HCC, HDIL and Jaypee Infratech among others.

In fact, Vakrangee and PC Jeweller have itself added nearly 37,500 retail investors each in the March 2018 quarter.

(Image credit: ET)

No lessons learnt, retail investors trapped again#Investments #Stockshttps://t.co/qzEmIHCfaR pic.twitter.com/HiPPnagLz9

— ET Wealth (@ET_Wealth) August 2, 2018

Worse, novices tried desperately to “average” their purchase price of the junkyard stocks, which is a classic case of throwing good money after bad.

“Average the price down” strategy backfires for retail investors | https://t.co/gNUBec5wuN#ETMarkets pic.twitter.com/tfAQbxgXLB

— ETMarkets (@ETMarkets) August 2, 2018

What is the meaning of “chor” companies?

Porinju has now explained what he meant by advising investors to buy “chor” companies.

“When I said invest in ‘chor’ companies, I never meant invest in fly-by-night operators. I talked about investing in companies that have sound business fundamentals but have lacked in corporate governance,” Porinju explained.

“With corporate reporting standards rising, these companies will have to reform themselves. If you get into such companies early on, you would, in the long term, end up owning good companies at a bargain,” he added.

“My premise was perhaps misinterpreted and misunderstood,” he said.

“I still believe the premise is right,” he emphasized.

Forget “good companies”, buy “good stocks”

Porinju has been perpetually advocating the theory that investors should always bear in mind the difference between “good companies” and “good stocks”.

A “good company” may be a “bad investment” while a “bad company” may be a “good investment”, he advised.

He also emphasized that he has been able to generate an eye-popping CAGR return of 33% over 12 years by buying so-called “bad companies”.

I love 'bad companies' by perception, but 'good stocks' – helped me to do reasonably well in Indian markets. pic.twitter.com/JtMdrdrDNF

— Porinju Veliyath (@porinju) July 15, 2015

Great Cos may not be Great Stocks:

Ashiana was 'Great Company' at ~325 in Feb, while I was buying Ansal Buildwell, a 'Great Stock' at ~70— Porinju Veliyath (@porinju) August 17, 2015

Sad that amateurs are chasing success stories at wrong prices; I have been warning about Page, Kitex, Ashiana, Atul Auto, Symphony, KSCL etc

— Porinju Veliyath (@porinju) August 17, 2015

World record for most multibagger gains from “bad companies”

We cannot be dismissive of Porinju’s theories because he holds the World record for the most profitable recommendations of so-called bad companies.

Several of these stocks have given incalculable gains.

Balaji Telefilms@31, Orient Paper@5, Orient Cement@32, KRBL@23, Mirza Intl@20 – all looking penny stocks, but not penny business. BUY

— Porinju Veliyath (@porinju) August 29, 2013

Billion Dollar 'penny stocks' idea ? https://t.co/raAxAumF8p

— Porinju Veliyath (@porinju) January 24, 2017

10x in 3 yrs! Many more KNRs in making

Trillion Dollar opportunity in Housing & Infra coming up, Grab it! https://t.co/2h7d3HW1Nv— Porinju Veliyath (@porinju) May 9, 2017

Nothing changed in Mirza, but stock price?

Keep investing simple, it's all about common sense! https://t.co/T4fFsJR46v— Porinju Veliyath (@porinju) May 10, 2017

Prof Aswath Damodaran supports theory that buying “bad companies” is “good investment”

Prof Aswath Damodaran is held in high regard by intellectuals and the intelligentsia.

He is regarded as an authority on complex macro-economic issues relating to the stock market.

In a piece written in March 2017, Prof Aswath Damodaran has explained the doctrine of “bad companies vs. good investments” in detail.

“You can have good companies become bad investments, if they trade at too high a price, and bad companies become good investments, at a low enough price. Given a choice, I would like to buy great companies with great managers at a great price, but greatness on all fronts is hard to find. So, I’ll settle for a more pragmatic end game. At the right price, I will buy a company in a bad business, run by indifferent managers,” the Prof advised.

The Prof also provided a ready-made template which will help us to pick the best investments.

It is notable that Prof Aswath Damodaran is not merely an academic spouting academic theories but is also a practitioner. He has recommended mega-bagger stocks like Apple Inc.

At $440/share, Apple is cheap. Can you pull the trigger & buy the stock? Good test of whether you are a value investor. http://t.co/hAoIYhSx

— Aswath Damodaran (@AswathDamodaran) January 28, 2013

Apple is the greatest cash machine in history & the latest earnings report confirms it. My story & value update: https://t.co/lOe4rcqNpP pic.twitter.com/FtvhgtnODm

— Aswath Damodaran (@AswathDamodaran) February 9, 2017

Apple has now made history by becoming the first company with a trillion dollar market capitalisation.

Apple market cap milestones:

Aug 2018: $1 trillion

Nov 2017: $900 billion

May 2017: $800 billion

Nov 2014: $700 billion

Apr 2012: $600 billion

Feb 2012: $500 billion

Jan 2012: $400 billion

Jan 2011: $300 billion

Mar 2010: $200 billion

May 2007: $100 billion

Dec 1980: $1 billion— Nilesh Shah (@NileshShah68) August 2, 2018

Time is ripe to buy potential small-cap and mid-cap multibagger stocks

Size doesn't matter!

'High-quality' companies & 'High-quality' stocks are not the same. Recent drawdown in small, mid-caps an opportunity to cherry-pick potential multi-baggers. pic.twitter.com/Zo54pVcWRh— Porinju Veliyath (@porinju) July 27, 2018

Porinju has now issued the clarion call that the time is ripe for us to aggressively buy small-cap and mid-cap stocks.

“This is a good time to invest in medium-quality midcap stocks. I am saying medium quality because there’s great value emerging in that segment after the recent correction. Top-quality midcaps are still pricey. This paranoia around midcap and smallcap stocks will go away soon,” he opined.

Is Porinju recommending the stocks referred to in the tweet?

A careful study of Porinju’s tweet reveals that he has revealed the names of 19 stocks and also disclosed that he is presently holding some of them.

| Stock | Description of business |

| Amrutanjan | largest pain balm co – century old |

| Biocon | largest in biosimilars |

| Essel Propack | largest laminate tube mfg globally |

| Finolex Cables | biggest brand, largest mfg |

| Forbes Gokak | largest in water purifier – Consumer |

| Force Motors | 60% mktshare |

| Future Consumer | large integrated farm to home food co |

| Granules | largest Paracetamol mfg globally |

| HSIL | largest sanitaryware in India |

| Ion Exchange | Water treatment-largest |

| Jyothy Lab | largest fabric whitener in India |

| Kokuyo Camlin | largest stationery co in India |

| KRBL | largest branded Basmati player globally |

| Mirza International | largest leather shoes exporter |

| Munjal Showa | largest shock absorber mfg |

| NIIT | No 1 in India, one of global leaders |

| Orient Paper | largest fan mfg and exporter |

| Shreyas | 65% market share |

| SRF | largest Nylon Tyre Cord mfg |

It cannot be denied that each of these companies is a powerhouse and a dominant leader in their own respective fields.

If these companies have generated mammoth multibagger gains for investors in the past, what is to prevent them from doing so in the future as well?

So, it is advisable that we take a cue from Porinju and buy such high-quality small-cap and mid-cap stocks before the paranoia evaporates and it is too late!

not right time to purchase small cap wait another 6 months for better vaiues

Don’t buy stocks with less than 2.50 per cent yield ..Look for stocks with decent record of dividend pay out. Harshamoy mukherjee

.

Barring one or two stocks, all his holdings are in deep red. Looks like he is buying Vakrangee, PCJ, Manpasanad which exactly fits his definition of ‘chor’ companies. Big pity on his PMS investors.

What a contradictory article!! Asking us to buy already multibagger stocks at lofty valuations of good quality stocks and speaking of buying low quality stocks with great valuations!!

Is the photo of feeding a calf and COW present in the photo to please some people?? Why can’t they share some BUY ideas of CHOR and cheap companies with good future, they will never? Then why they talk to media and waste our time

what about sunil hitech. he was bullish on this with good management. he seemed to nailed his own foot and many of his folowers.

Cmon man admit your blunder. Its sometimes good to accept that you were wrong. Well the market is supreme and it beat you down hollow by forcing you to get carried away . Blinded by success should we say. Now you give names. Junkyard companies…well so easy to call them junkyard now….hindsight does make it easy.

Bhai log & all senior citizens & investors !

Last few days everywhere everyone screaming as market going down & blame game full on. As per media Porinju has lost his touch & Basant is the new king.

let me tell everyone that after losing my underwear so many times in the market only last time many small investors lijke me who have no one to lead have made some small amount with Porinju !

Porinju is a Badshah & he will bounce back soon & remember he is the only one who have provided some comfort during all stages of market . so please dont ignore him- do your own study & then invest.

Rakesh is shahenshah but no tip for small investor.

only Porinju & Vijay help small people like us.

Porinju & only porinju.

Don’t follow any one advising third grade companies, just buy top or second company of a growing sector scattered over a time like SIP, and enjoy stock market without loosing sleep.

In the list above, NIIT is referred to as a global leader.It Global leader of what exactly ?

I remember ,asI had byread, value investor Guy Spier admonishing his father, when he lost haveyly in the Wall Street,. not to buy any thing which is being sold by the street. This is a lesson which I always keep in mind.

He was right after all.. Manpasad kwality vakrangee pcj etc are zooming non stop in upper circuit since last 2 weeks