Making millionaires out of novices Porinju ishstyle

It may not be an exaggeration to state that if we had obediently followed Porinju’s recommendations, today we would also have been strutting around like Millionaires with bulging bank balances.

Unfortunately, we have behaved with our customary rebellious and defiant nature with the result that we are still languishing in a poverty stricken state even though the recommended stocks have turned into mega multibaggers.

1000% Gain (10-bagger) from one tweet!

Porinju’s famous tweet of 29th August 2013 by which he recommended five stocks holds the World record for the most profitable tweet ever.

Balaji Telefilms@31, Orient Paper@5, Orient Cement@32, KRBL@23, Mirza Intl@20 – all looking penny stocks, but not penny business. BUY

— Porinju Veliyath (@porinju) August 29, 2013

It hurts to see the mammoth gains that each of the five stocks have notched up in the four years that have lapsed since the recommendation.

| Stock | Reco price (Rs) | CMP (Rs) | Gains (%) |

| Balaji Telefilms | 31 | 170 | 430 |

| Orient Paper | 5 | 100 | 1614 |

| Orient Cement | 32 | 154 | 365 |

| KRBL | 23 | 469 | 1811 |

| Mirza Intl | 20 | 160 | 695 |

| Total | 4915 | ||

| Average | 983 | ||

KRBL and Orient Paper are magnificent 18 and 16 baggers respectively.

Balaji Telefims, which is/ was trashed by the academicians for alleged lapses of corporate governance, is up 430%.

Of course, Balaji Telefilms’ surge did not come as a surprise to me because illustrious investors like Radhakishan Damani, Vallabh Bhanshali and Rahul Saraogi are well entrenched in it.

Mirza International, a little known manufacturer of footwear, is up nearly 700%.

The simple average return from the five stocks is 983% which is just mind-boggling.

The examples of multibagger stock recommendations can be reiterated ad nauseam.

KNR Construction, which was quoting at a throwaway valuation of Rs. 270 crore commands a market capitalisation of Rs. 3000 crore today, just 40 months later, resulting in 10x+ gains.

KNR Construction @ 97 – MktCap 270Cr. Clean BS, good business, good if you want to bet on Infra in the changing environment.

— Porinju Veliyath (@porinju) April 29, 2014

Porinju’s confident prediction that Blue-Chip holding companies will generate 100% gain only because the discount at which they are quoting will narrow also appears to be coming true as I have analyzed in detail in my piece.

It is notable that the holding companies are blue-chip and fail-safe stocks and are the ideal investment even for conservative investors.

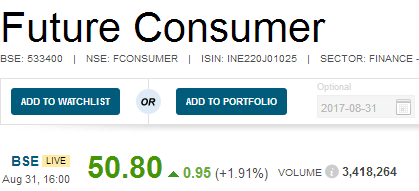

Future Consumer (FCEL) yields 366% gain

Anyway, there is no point in crying over spilt milk. We need to keep our eyes and ears open for future buying opportunities.

Porinju recommended Future Consumer Enterprises Ltd on 26th March 2015 on the logic that it has a clean balance sheet, futuristic business model and that the management is buying the stock.

FCEL | 10.50 – Mgmnt buying consistently!

Only company in the group worth researching; clean balance sheet and futuristic business model!— Porinju Veliyath (@porinju) March 26, 2015

The stock price has since surged from Rs. 10.50 to Rs. 51, yielding massive gains of 366%.

Future Consumer crosses a landmark today – 50 bucks ? 2019-20 should be their starting phase of REAL growth on the balance sheet!

— Raghav Chaudhary (@MrRChaudhary) August 30, 2017

The logic for recommending the stock is amplified in the following words:

“This (Future Consumer Enterprises) is a stock I think was around Rs 14 when we discussed it in August. I have been buying the stock since it was Rs 10 a few months back under PMS. This is the largest holding in our portfolio manamgent and I have bought this stock for the next 10 years which we discussed during August. In an emerging economy like India, lots of structural changes could be happening in some industries, some consumption pattern, the culture changes. That is where investors can make real big money and long-term big multibaggers. I always consider FCEL a company with clean balance sheet and an excellent business model. If you look at the numbers today, the revenue profitability and all is different because this company is just getting built up. It is in that creation mode. It has got a long way to go. Yesterday, they were talking about Rs 20,000 crore of revenue by 2021.

…..

… the current revenue is around Rs 3000 crore. The market cap is around Rs 3000 crore too and so there is a huge growth potential. The business model — starting from the procuring products from the farmers and villages, sorting it, cleaning it, grading it and packing it, branding it and selling through their network and other networks — is an amazing model and a lot of middle men can be avoided. Today when I talk somebody producing tomato, we find the farmer gets Rs 5 and we buy it in Mumbai at Rs 30, which is very unfair. The farmers should get at least Rs 20 and you may pay Rs 25. So that is an ideal situation where everybody benefits, the country progresses and the farmers really need a helping hand. I am talking about the rural economy. The budget as expected has given a big focus on the rural and agri economy. Now, see one thing I like about the government is when you look from your stock market perspective, they are thinking big. The size of the projects are big and the finance minister has said the farmers income should double in the next six years. Do you have any idea what is the farmer income today on an average in India? It is ridiculous. It is near to zero. I am telling you. Do not give any figure. It is as good as zero. So doubling it in six years is bad. It should be doubled in three years that is what I feel but just see how people are trying to oppose that. That kind of negativity is pulling down the country.”

He also periodically egged us to buy the stock:

FCEL – Vision 2021 @kishore_biyani | some of you might have missed this presentation:https://t.co/ZlZLf29xon

— Porinju Veliyath (@porinju) April 3, 2016

@porinju PICKS

Future Consumer

Well-integrated Multi-bagger Agro stock

See 25-30% compounding return in 5-10 yrs@ETNOWlive @darshanetnow— avanne dubash (@avannedubash) August 11, 2016

Even from that stage, the stock is up 138%.

I love Future Consumer, Kishore Biyani is the king of retail

Porinju described Kishore Biyani as the “king of retail”. “I love the stock,” he added.

He emphasized that the revenue target of Rs 1 lakh crore set by Kishore Biyani for the Future Group’s is quite achievable.

'Future Consumer' is the one stock for the future. Redefining the model. If it works and profits come through, MAJOR gains ahead,

— Sathyesh Bhat (@SathyeshBhat) August 30, 2017

Forget bookish knowledge, be practical

Porinju rapped novice investors on the knuckles for being obsessed with “number crunching” and missing the wood for the trees.

The rap is appropriate because novices have a tendency to strut around spouting quotes from Warren Buffett and Charlie Munger even though they know diddlysquat about investing.

'India Equity Story', next 5 years – well-bred & well-read guys doing number crunching will miss it! #CommonSense #Wisdom We hold F Consumer pic.twitter.com/CKZFU3hQrD

— Porinju Veliyath (@porinju) August 30, 2017

He also took at a dig at us for consistently ignoring his recommendations and lamenting thereafter.

"Many receive advice; few profit by it."

— Porinju Veliyath (@porinju) August 8, 2017

Not a single research report on Future Consumer though there are tomes on Infosys and TCS

Porinju’s lament about investors missing the wood for the trees rings true when one sees that there are hardly any research reports covering the small-cap stocks which have become mega multibaggers. Instead, there are encyclopedias written with respect to large-cap stocks which hardly budge an inch.

It is clear that the focus area of the academicians is in the wrong place.

Conclusion

The writing is clear on the wall that we have to abandon our obsession with bookish theories and instead adopt a practical stance whilst evaluating stocks and look at the big picture. If we do this, we can still make up for lost opportunities!

Why is the target price in next 5 years for future consumer?

Please look at Sanwaria Consumer formerly sanwaria agro also in same business but market only 500 where revenue more than 5000 crore.

Good management team and investor friendly also.

@admin please prepare report for this company so that we can gain from this company at early stage.

Thanks

Sunil

Sunil,

Do you know about the meaning of 0 is Cash flow. Why zero-zero in screener.in for two three years for SANWARIA CONSUMER LIMITED. In rate start, it is for one year.

For this type of company which require more capital cash flow would always be zero. Look at sales and profit and the decide.

It has huge debt so I will stay out off it.

Thanks

Anil

Dear Anil

Please look at sales figure and investor presentation because of huge expansion and also it debts is secured against inventories.

Promoter itself have taken equity shares at the rate Rs 12.5 .

In retail sector ,D mart although over priced but worth accumulating to ride long term.

I would recommend Raghuvansh Agrofarms . a niche organic player in organic A2 milk and organic fruits. Also, producing organic fertilisers and pesticides. Last year earnings increased by 400%. Available at throwaway valuations of 10. It is from the SME segment and the lot size is 2500, but buy it if you can. It will be 20x by 2021.

when was it 10?

Current EPS is 4.5 . Trading at around 48 .