Porinju, you have not really answered Tanvir’s and my question

Porinju tried to escape without giving specific stock recommendations. He tried to beat around the bush by talking about generic investment theories.

However, he had grossly underestimated the vigilance of Ayesha Faridi and Tanvir Gill.

Both ladies are famed for their incredible interrogating skills and ability to ferret out actionable information even from recalcitrant guests.

We have seen earlier that even legends like Warren Buffett, Rakesh Jhunjhunwala, Mark Mobius and Mohnish Pabrai obediently answer questions that are asked by the duo without beating around the bush.

Some like Mark Mobius and Mohnish Pabrai also offer stock recommendations in the form of Diwali Gifts due to the persuasive abilities of the two ladies.

Tanvir asked Porinju (@4.30) which banking and insurance stocks are good now for “bargain buying”.

Porinju did not name any stock. Instead, he referred to the statement by Billionaire Uday Kotak of how the share of private banks would surge to 50% from 33%.

“There is lot of things to look forward to in well managed private sector banks with a reasonable or low NPAs,” he advised.

It is worth recalling at this stage that Billionaire Uday Kotak’s statement has been interpreted by Basant Maheshwari to mean that NBFCs and small private banks will grow at a scorching CAGR of 27% to close the gap between themselves and the PSU Banks.

PSB 2.0 | @udaykotak To CNBC-TV18 : Assuming organic growth of private banks such that their share goes up from 30% to 50% market share pic.twitter.com/G1bji7JmtY

— CNBC-TV18 (@CNBCTV18Live) March 20, 2018

Reading between the lines from this @udaykotak interview. A 30:70 ratio between private and public moving to a 50:50 ratio in 5 years assuming a 15% industry credit growth means a 27% CAGR for private financiers. Smaller companies in niche segments can grow faster ! https://t.co/CgZQNlSM6x

— Basant Maheshwari (@BMTheEquityDesk) March 21, 2018

However, the absence of specific stock names in Porinju’s dissertation caught Ayesha’s Faridi’s attention.

“Porinju, you have not really answered Tanvir and my question,” she said (@ 9.45) in a sweet and yet firm tone, making it clear that specific stock recommendations are expected from him.

(Tanvir Gill & Ayesha Faridi conducting meticulous research before an interview with Rakesh Jhunjhunwala)

Stocks which can create “immense wealth”

To Porinju’s credit, once he realized that there is no escape, he came clean and revealed the names of stocks that can create “immense wealth” for investors.

#Exclusive | @IDFC_Bank & Capital First safe are interesting ideas under Financials theme; Cos like Godrej Ind, Tata Global, Godrej Agrovet can create immense wealth, says @porinju of Equity Intelligence India in interaction with @AyeshaFaridi1 @tanvirgill2 @GodrejGroup pic.twitter.com/kfYNILq0M9

— ET NOW (@ETNOWlive) April 2, 2018

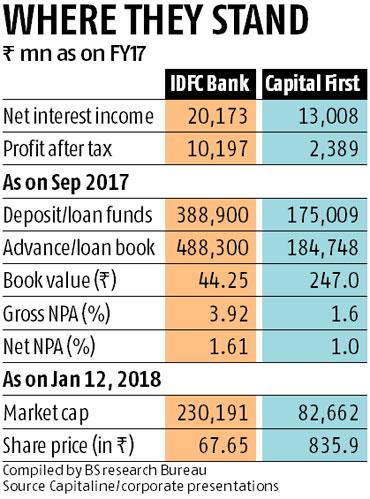

IDFC Bank + Capital First = Next Bajaj Finance

For various unknown reasons, IDFC Bank has languished and remained at the bottom of the barrel over the past several years.

However, its impending merger with Capital First under the leadership of the charismatic V. Vaidyanathan will transform fortunes and result in mega multibagger gains for investors, Porinju opined.

(Images credit: Business Standard)

“I was just looking at IDFC Bank. The stock is priced at around Rs 48, maybe around Rs 16,000-crore market cap. Now that is getting merged with Capital First and it is going to be around Rs 22,000 crore market cap today. Mr Vaidyanathan is a very good leader and maybe under his leadership, this merged entity looks like a very safe bet.”

Prima facie, Porinju’s theory makes sense. Capital First has in fact been referred to by experts as the “next Bajaj Finance” because it is walking in the illustrious footsteps of the latter.

Idfc bank would easily give dcb kind of returns.. so if it looks like a good story to anyone… They should buy capf at cmp and hold idfc bank for at least 2 more year to see some serious growth.

— Ronit Chugh (@ronitchugh1) April 2, 2018

HDFC Standard life looks good upside potential candidate and Capital First a long term wealth creation story among stocks mentioned.

Disclaimer : Holding both in our core portfolio.— TreasureHunt (@TreasureHunt_TH) April 2, 2018

I support the idfc-capf merger story which is gonna be a serious mutually beneficial alliance and once the dea is completed… Just watch them surge like crazy… @porinju @ETNOWlive

— Parag Gaikwad (@parmo_03) April 2, 2018

Tata Global Beverages: “Dirt cheap” FMCG stock + “Next Britannia”

Tata Global Beverages is one of Porinju’s all-time favourite stocks.

He first recommended the stock in February 2016 when it was languishing at Rs. 107.

TGBL @ 107, can create huge shareholder wealth if smarter guys run the company. We hold. @TataCompanies @RNTata2000 https://t.co/4JK4nH1QCB

— Porinju Veliyath (@porinju) February 20, 2016

At the CMP of Rs. 273, hefty gains of 115% are on the table.

Tata Global Beverages is also a favourite of Rajen Shah of Tradebulls.

He recommended that we buy the blue-chip FMCG stock because it is quoting at “dirt cheap” valuations and is slated to be the “next Britannia”.

The reference to Britannia is very significant because this stock has been a mind-boggling mega bagger over the decades.

Britannia at Record High

MCAP at 60500 Cr

What a Story – Co started with a meagre Rs. 295 capital in 1892

Watch for BBTC; holds 50.7% stake in Co@BritanniaIndLtd @CNBCTV18Live #FMCGisLife— Mangalam Maloo (@blitzkreigm) April 2, 2018

If TGBL is able to achieve even a fraction of what Britannia did, we can all retire in Hawaii with bulging bank balances.

Indian Hotels: cyclical transformation

It is worth recalling that Porinju Veliyath and Ashish Chugh (“Hidden Gems”) have both sent the clarion call that hotel stocks are undergoing a cyclical transformation and the time is ripe to tuck into them.

The industry is turning around after a decade, despite disruptive @Airbnb etc. High cost and crack down on black money could moderate supply going forward. Lower GST is tailwind for 3&4 Stars @safiranand @hiddengemsindia

— Porinju Veliyath (@porinju) November 11, 2017

Industry has seen a down cycle followed by multi year consolidation – leading to a a leaner structure & cost rationalisation. Case of operating leverage with higher occupancy. https://t.co/4pjbmrkSOW

— Ashish Chugh (@hiddengemsindia) November 11, 2017

Indian Hotels, which runs Taj Mahal Hotels, is the ideal blue-chip stock to buy.

To understand the investment rationale of Indian Hotels, we have to turn to the research report issued by Ajay Jaiswal of Stewart & Mackertich.

He also recommended the stock in Outlook Business as his best stock pick of 2018.

Porinju and Ajay Jaiswal have also recommended Royal Orchid Hotels (ROHL) as an ideal small-cap stock to buy.

Royal Orchid is living up to expectations and notching up hefty gains as explained in the latest research report.

We can also take a close look at Oriental Hotels (under Tata management).

According to a research report by ICICI-Direct, Oriental Hotels has magnificent upside potential of 64%+.

Godrej Industries: undervalued holding company

Godrej Industries is the ideal stock to buy because it gives us a toe-hold into chemicals (stand alone), real estate (Godrej Properties, 56.7%), FMCG (Godrej Consumer, 23.8%) and Agriculture, Dairy (Godrej Agrovet, 58%).

QTD performance of

Godrej consumer +8%

Godrej properties +12%

Godrej agrovet +8%Above 3 contributes 95% of Value to Godrej Industries, whose QTD perf is -10% .

Implies discount has widened by 20%

QTD : Quarter to day— Iqbal (@MohamedIqbal_s) March 2, 2018

Varinder Bansal has conducted an in-depth study of Godrej Industries and opined that it is quoting at such rock-bottom valuations that we are getting the stand-alone business literally for free.

Varinder Bansal’s theory is corroborated in the latest research report issued by Way2Wealth.

Way2Wealth has provided a detailed explanation of the various diverse businesses managed by Godrej Industries and opined that the steep discount at which the stock is now quoting makes it an irresistible buy.

“GIL is a holding company for all major Godrej Group Companies. In the recent price correction and at relevant stakes in the subsidiaries and associates we believe the holding discount has widened from its earlier average of 15-23% to 45-50%. We believe this gap will narrow down given the strong growth prospects of the subsidiaries in the next 2 years and hence we are POSITIVE on the stock.”

Promoters with proven track record of wealth creation can create beautiful wealth for shareholders

“Some of these wonderful big themes have promoters with proven track record of wealth creation. The investors can always bet on such large companies with more clarity and visibility in the given consumption themes for the country,” Porinju stated.

“They all are very large businesses in such a huge country and if well managed, these companies can create beautiful wealth for the shareholders in the coming years,” Porinju added even as Ayesha Faridi and Tanvir Gill smiled approvingly.

in financial space pnb housing, ktk bank and au small finance bank are dirt cheap and pvr is good consumption story for next 10 years

Can you advise me on the following scrips :

Lloyd Steels

Urjja Global

Karuturi Global

these are junk, come out as soon as possible

Capital first was good on fundamentals since last few years, yet it hasn’t really generated any impressive upside yet.

Should w e keep holding GVK Power and Infra Shares , they seem to be going down in recent times. Between GAIL and IPG which one is better for a long term

Hi,

Can anyone advise on the following shares :

Hindustan Zinc

NMDC

PPAP Automotive

Arun

PPAP Auto is an excellent stock in the auto ancillary space. It has large customers like Maruti Suzuki and will do well.

Hindustan Zinc and NMDC are PSU stocks with high dividend yield. However, because they are commodity stocks and not secular growth stocks, their long-term future cannot be predicted.

Thank you for the advice , I have purchase some shares of Bhansali Engineering Polymers some time back and it seems to be going down of the late. would you be able to comment on the same.

Bhansali Engineering Polymers Ltd (BEPL)’s stock price had increased too fast. It is up nearly 500% in the past 24 months. A lot of valuation froth is now correcting. It does have a strong business profile and can be accumulated after it consolidates a few quarters.

cAN ANYONE COMMENT ON MANPASAND BEVARAGES, IS IT LIKELY TO REBOUND TO THE LEVELS IT HAD REACHED EARLIER . IS IT WISE TO ACCUMULATE THIS SHARE

I have 100 shares of IFDC purchased recently . what will be the impact of IFDC and Capital First merger on my shares . Will they get reduced. What will be the impact on IFDC Share value of those 100 shares.

Is it advisable to accumulate IFDC shares or better buy capital first shares.

Would appreciate to let me know about Vakrangee and PC JEwellers