Rakesh Jhunjhunwala talks freely about sensitive political issues

Some news channels make the tactical mistake of sending rookie journalists to interview legends like Rakesh Jhunjhunwala.

Invariably, one can see that the rookie comes ill-prepared and is unable to keep pace with Rakesh Jhunjhunwala’s razor-sharp thinking.

The Badshah then tears them apart and makes mincemeat out of them.

Thankfully, the mandarins of ETNow know better. When interviewing legends, they make sure that their best talent in the form of either Ayesha Faridi and/or Tanvir Gill are deployed.

The two ladies not only bring irresistible charm to the table but thoroughly prepare themselves with all facts and figures relating to the interviewee and the subject matter under discussion.

They know what questions to ask and how to ask them. They also have the presence of mind to take leads from what the interviewee is saying and to ask relevant counter-questions.

#RJOnETNow Rakesh Jhunjhunwala says

Local flows will support the market

Buy shares with conviction and patience

Popular stocks may not be very profitable

Affordable housing will boost cement & steel— Ayesha Faridi (@AyeshaFaridi1) February 23, 2018

(Tanvir Gill & Ayesha Faridi prepare to grill Rakesh Jhunjhunwala on an earlier occasion)

Unfortunate we had Mrs Indira Gandhi as the Prime Minister. She institutionalized corruption

Rakesh Jhunjhunwala normally steers clear of political issues. He rarely expresses any opinion on the political leadership and restricts himself to making generic statements.

However, the interviewer cleverly appealed to the Badshah’s emotions by referring to the never-ending banking scams and the colossal losses that investors have suffered from junkyard PSU Bank stocks.

The Badshah got very agitated. He pinned blame on Indira Gandhi for nationalizing the Banks.

“I feel it was unfortunate that we had Mrs Gandhi as the prime minister. She institutionalized corruption. Till Shastriji, corruption was looked down upon as a taint, as a blame. She institutionalised it more than that she nationalized our banks, insurance and the coal industry,” he said with remorse and regret in his tone at the sorry state of the Country’s politics and finances due to the shenanigans of unscrupulous politicians.

"I feel its unfortunate that we had Indira Gandhi as PM because she institutionalised corruption, nationalised banks, insurance & coal. Govt opened up coal last week, sure that there will be political will to privatise PSBs," Rakesh Jhunjhunwala on banking sector crisis in India pic.twitter.com/8H3NAs2bRe

— ET NOW (@ETNOWlive) February 22, 2018

He also pointed out that the PSU Banks are in such a pitiable state that no one will be willing to buy them even with a barge pole.

In fact, such is the sorry state of affairs with regard to PSUs that the Hon’ble Aviation Minister had referred to a potential buyer of Air India as a “Bakra” (i.e. sacrificial goat), the Badshah said.

“There is likely to be no buyers for buying those banks today. Unless you consolidate the PSU banks into four, I do not know what sense it makes. You have to consolidate all the PSU banks into three, four banks and you will have to sell all of them,” he said.

It will take at least five years and will require enormous political will, the Badshah predicted.

(Dilli ki Sardi – Ayesha Faridi looks resplendent in winter clothing)

NAMO’s reforms will lead to economic upswing

In sharp contrast to the criticism with regard to Indira Gandhi’s policies of Nationalisation, Rakesh Jhunjhunwala heaped praise on NAMO.

He explained that the radical reforms implemented by NAMO in the form of demonetisation, GST, Banking reforms etc would send the economy into an upward trajectory.

He also paid tribute to NAMO for slowly but steadily undoing the nationalisation of the coal industry, by allowing the private sector to enter the sector and compete with Coal India.

DON'T MISS: Bull #market to continue, but get pro advice: @R_Jhunjhunwala pic.twitter.com/5rW3NNsBVU

— ETMarkets (@ETMarkets) February 23, 2018

He also pointed out that there would be a rapid increase in private investment. The total private sector investment in the economy to GDP is it at 27-28% and will reach 35% over the next three-four years, the Badshah said in a tone of supreme confidence.

He also explained that the mega expansion projects being announced by the titans of industry makes it clear that there is neither a dearth of demand or of capital.

“Tata Steel has recently announced investment in expansion of 5 million tonnes, Volvo is talking about expanding its vehicle capacity. Chemical capacity in India is doubling.

So, I do not see why it is going to be slow. You cannot keep an economy like India at 27% of investment of GDP for long. It is 46% of GDP in China and it is continuing for 15 years“, he said even as the distinguished audience comprising of captains of industry nodded heads in agreement.

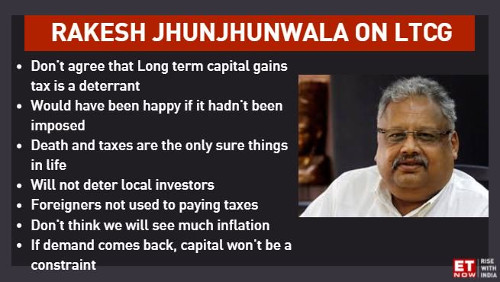

LTCG tax will not deter investments into India

Rakesh Jhunjhunwala soothed our nerves on the impact that the dreaded LTCG tax would have on the stock markets.

It may be recalled that novices have been in a quandary over the past few weeks due to the conflicting opinions expressed by expert investors.

While Samir Arora and Shankar Sharma scared us by opining that the LTCG tax would cripple the stock market, Porinju Veliyath and Ridham Desai welcomed the tax and rubbished fears that it would deter foreign investors.

Thankfully, Rakesh Jhunjhunwala has extended his support to the latter view.

“I do not agree that long term capital gains tax is a deflator because the alternative sources of investment all have an higher rate of tax. Long term capital gains is capital gains plus STT. The company that has got 20% debt is fully taxed. So for the person who is investing in equities, comparatively is not at a disadvantage,” the Badshah said even as the novices heaved a sigh of relief.

“It is not going to deter any serious local money,” he said though he warned in the same breath that foreigners may be (temporarily) dissuaded because they are not used to paying taxes.

Bull market will continue for decades

“This bull market in India and Indian stocks is going to continue but I do not know for how many decades! The basic reasoning is that because of the economy we grow at 7%-8% and if I feel that at any given time, the India’s economy will grow in double digits and we have 4-5% inflation with 15% nominal growth,” the Badshah confidently proclaimed.

He did, however, caution that equity valuations may moderate to 15% to 18% and sometime may be negative.

“You should invest for extended periods of time,” he advised.

How to find multibagger stocks

Rakesh Jhunjhunwala knows that no interaction is complete without his offering tips to novice investors on how to find multibagger stocks.

This time is no different.

He offered six important tips that we should follow if we aspire to walk in his illustrious footsteps and rake in mega multibaggers of our own:

(i) Pay the lowest price and get the greatest value:

“The most critical decision is price. While it is important what we buy, it is more important at what price we buy,” the Badshah said.

The novices in the audience looked dumbfounded and so the Badshah elaborated with examples.

He pointed out that in 1999, he had bought 55% of United Spirits and United Breweries for a paltry sum of Rs 6 crore.

The investment was opposed by the Badshah’s well wishers because Vijay Mallya had the dubious reputation (even then) of being a “thief” and of siphoning off funds from his companies.

However, the Badshah disregarded the warnings because the concerns about Vijay Mallya had destroyed the valuations of United Spirits and United Breweries to such an extent that they were quoting at throwaway valuations.

“I am getting 55% of India’s liquor industry at a valuation of Rs 100 crore that means the entire liquor industry in India was being valued at Rs 200 crore. I thought it was ridiculous,” the Badshah exclaimed in a tone of great excitement.

“I made at least 15 times my money in three years. If I had held those shares today the value of that investment today would be Rs 2000 crore,” he added.

(ii) Look at the size of the opportunity:

Here, Rakesh Jhunjhunwala cited Infosys as a textbook example of how the growth of the company is directly related to the size of the opportunity.

Infosys was an unknown entity before the advent of internet. However, the rapid growth of the internet gave Infosys the opportunity and means to also grow at a rapid pace.

Yet another example is that of Colgate Palmolive. The Company is dependent on the demand for toothpaste in India.

(iii) Quality of management:

Rakesh Jhunjhunwala emphasized that the mere fact that there is a huge scale of opportunity is not sufficient if the management does not have the vision and the ability to capitalize on the opportunity.

He cited the example of Mastek to illustrate how poor management can squander away all chances to make it big.

“Mastek and Infosys were born on the same day, they had the same advantages, the availability of engineers in India look at where Infosys is and what Mastek is today”, he said.

“You have to look at the competitive ability and then for every entrepreneur here, there is one very, very important word – scalability,” he added.

(iv) Pay the price for a Maruti and get the return of a Mercedes:

“The return on a Maruti should be that of a Mercedes,” Rakesh Jhunjhunwala said.

He also advised that we should invest in those small-caps which stand chance of becoming large-cap stocks in the foreseeable future.

(v) Don’t overanalyze:

Some novices get obsessed with number crunching and write reams of pages when they are researching a stock.

Rakesh Jhunjhunwala suggested they are following the wrong strategy and missing the woods for the trees in their obsession for detail.

He advised that it is sufficient if we keep and eye on the working capital cycle, capital intensity and the integrity of the management.

“I do not overanalyse. I decide on an investment in one hour. If I think it is good value and there is liquidity, I invest”.

He also clarified that he makes the investment even if there are unanswered questions.

“When I invest, I am very uncertain, there is nothing sure,” he explained.

(vi) Be patient with investments:

Rakesh Jhunjhunwala took the opportunity to give novices a rap on their knuckles.

Most novices are fidgety and expect their investments to turn into glorious multibaggers overnight. When that does not happen, they get frustrated and dump their investments even if it is at a loss.

“A lot of investments test your patience and you doubt whether you have made a wrong investment,” the Badshah counselled in a soothing tone.

He gave the example of the “very-very large” investment he made in Escorts.

When the stock price did not budge upwards, most investors got fed up and deserted the company.

However, the Badshah held on tight to the stock and also added to his position whenever there were dips.

“I bought the shares at Rs 125 and today the price is Rs 850. But for two and a half agonizing years, I was the only buyer and everybody would say what are you buying, what are you buying”, he said with a big smile on his face.

“So, it is also a matter of conviction, patience and luck,” he emphasized.

Learn from Radhakishan Damani ‘s D-Mart on how retail shopping (e-commerce) can be profitable

It may be recalled that Rakesh Jhunjhunwala was the first to sound the grim warning that e-commerce companies like Flipkart, Snapdeal etc are sinking ships owing to their wrong and unprofitable business models.

“Boss, I Will Not Invest In E-Com Cos At These Valuations,” the Badshah had then proclaimed, much to the shock and surprise of the industry.

“Forget the valuation, where is the completed business model? I want to know Flipkart’s business model. I want to know how you will be profitable?” the Badshah asked, baffling investors who have pumped in Billions of dollars into these ventures.

Rakesh Jhunjhunwala’s bold move inspired other luminaries like Prem Watsa, Samir Arora, Mohnish Pabrai, Mark Cuban and other to come out of the closet and counsel e-com investors to be wary of where there are pumping in money.

What do you call valuations of Indian internet companies?

Kehte hai isko hawa hawaii, hawa hawai, hawa hawaiiiiiii.— Samir Arora (@Iamsamirarora) March 5, 2015

I don't short, but if I did, l'd short Flipkart. Not gonna make it. Bad DNA. https://t.co/sWYlbfJSXv

— Mohnish Pabrai (@MohnishPabrai) February 10, 2017

Even Aditya Puri, the illustrious head honcho of HDFC Bank predicted that PayTM would meet an inglorious end because of its business model.

Later, we saw that Rakesh Jhunjhunwala’s prediction came true because several e-come ventures like StayZilla, Local Banya, Tiny Owl folded shop and left their investors, creditors and employees high and dry.

The Badshah counselled the young entrepreneurs in the audience to take a leaf from Radhakishan Damani’s techniques on how to conduct a retail business in a profitable manner.

“Look at D-Mart. When Mr Damani started it, it was profitable at first.”

AVENUE supermarts hits a new high today at 1288 ! market cap now surpassed 80000cr!

— Sonia Shenoy (@_soniashenoy) February 23, 2018

The Badshah was irked by the fact that e-com companies take pride in suffering losses on the logic that it increases the Gross Merchandise Value (GMV).

“I do not know what kind of mathematics is this but the greater the loss, the greater the valuation!” the Badshah thundered.

“When I start with the idea that I incur a loss and build a business, where are the economic efficiencies?” he asked.

“When I keep incurring a loss of $15 billion or $10 billion a year, that means I am subsidising my customer. I will know my true consumer when I charge the true price” he explained.

Rakesh Jhunjhunwala advised the enterprenuers to stick to the traditional business concepts of creating efficiency first and scaling up later.

He reminded them that none of the world’s great businesses have been built with investors’ money.

It is explicit from Rakesh Jhunjhunwala’s advice to the entrepreneurs that if Radhakishan Damani’s D-Mart can rake in mega gains for investors, there is no justification for Flipkart and Snapdeal to cause their investors to suffer losses!

I agree with each and every word said by RJ. Great thoughts, great clarity and no ambiguity.

yes first indira than rajeev and lately sonia did the same damage to economy

Modi is the biggest destroyer of Indian economy ever.

Unfortunate to hear a person who has made money but talk only about one aspect. What was the answer to private banks not lending for agricultural crisis of 1967? was there any other answer? what does Mr. JhunJhunwala think his crowd of share-walas do over the years ?how have they helped the Nation? (at least Indira Gandhi fought wars and the 1967 FAMINE and did her bit) Created many scams of which INFO must be there in the market ?Now the Nirav Modi , Mehul Choksi scam, or the Ketan Parekh scam , or the Harshad Mehta scams are all from which space and what right have these “extra clever” people to talk about Honesty? What is great about this Damani character -putting up KIRANA stores? DUM hai to compete in Technology not Dal and Sabun -leave it to mom and pop who barely can make ends meet -woh bhi Kha lega like RIL and BIRLA entering retail?

This article though it is quoting an opportunistic’s words does not deserve any comment. Perhaps the author, admin, and owners of this site had expressed their opposition to Congress party and its leaders. Even a comment written against present ruling party and its leaders and even some supporting fund managers won’t even see light, I mean never been published here. thinking of stop browsing this site.

But intellect n capacity of politicians should b understood by public.

All those who win elections are not equally capable.

Nation suffers inefficiency of leaders.

I agree…. From being a regular I hardly ever visit this site. All because of the bias and preferences of the admin in here.

They infact not only not publish posts which are critical but also vigorously ban members who are critical of members who write baseless baised posts

I don’t expect this post to be published as well

Exactly, many such gurus does not know what was India in 1947. A nation which fought many wars with neighbours, one which does not had even own airline, centuries old cast system, totally fragmented society in terms of religion and cast and subcasts. untouchability, everything was a mess of hell. Congress and Nehru later Mrs.Gandhi contributed a lot to build this nation. Birth of bangladesh is the most appreciable one. many bjp acticits who are alive in this site does not know much about old India. or they do not want to digest that

I may not know what India was in 1947, but I do know what Germany and Japan were at the end of the world war and what they are now.

I also know what China was just three decades ago and also some other countries who attained their freedom around the same time.

Japan & Germany or Singapore are very small countries. Their growth can not be compared with India.India has to contend with huge diversities in terms of language, class, caste, religion, illiteracy, resource crunch,etc ,etc. In hindsight a lot could have been done better but we have done reasonably well and hopefully do much better in coming years.

Now everyone wants to privatise the PSU banks, those days many banks were nationalized. What was the reason to nationalize then because it is metioned among the achievements of Mrs Indira. Can someone explain?

Nationalisation, in hindsight, looks like a bad step now. Then in 1969, it was implemented to support Indira’s Garibi Hatao program, but no doubt been misused, but not just by Congress, but all the other party govts that came to power later – VPSingh/Chandrashekar 1990, Gujral/Devegowda 1996, Vajpayee 1998-2004 and the current regime of NaMo.

Certainly, the PSU banks have been misused over the years -just like all that is in govt control like Railways, Air India and other PSUs – at one time, through the Minister of State for Finance, Mr Janardhan Poojary, a loan mela was organised, giving the poor some Rs 5000 loans in the early 1980s. This became a popular measure then, but like all things that the govt does (whether Cong or BJP), this was also beset with allegations of kickbacks/cuts before the benefit reached the beneficiaries.

But one thing is clear, the total amount which most poor people received wouldnt go anywhere near what Mallya, NiMo, Chokshi managed to loot from the country. And, that poor man’s loan mela money did not leave the country, unlike what is happening in NaMo time. Some supporters of the current govt are claiming that the frauds and scamsters are running away scared of Modi! What a joke! They are not running away, they are going abroad to settle down in cozy places like St Kitts (as read on the media), London, NY etc with our (tax payers) money, they are not going there to beg on the streets!

And we should also compare the loan mela to the current govt policy on loans on which NaMo govt does drum beating! What is this e-Mudra scheme? Any idea? nothing but similar to Poojary loan mela, but a much larger unsecured loan, which in a few years will be provisioned/written off. Some noise will be made then, and all will be forgotten when our compromised media will find some assault/murder/rape/Kashmir/students/cows type chutney for its Breaking News Dosa at that time, or some IPL cricket or some saas-bahu will run the prime time, and we will live happily ever after praising the govt!!!

We are after all a great nation, the largest democracy in the world!

Thank you

The severe drought s between 1960 – 1970 and socialism were the decisive factors. The banks owned by Industrialists gave loans to themselves but refused to lend money to farmers. INDIRA nationalised the banks which led to better drought management in 1971-1974. Also war in 1971 could be financed. The opposition, during this period took a lot of advantage and student riots occurred all over North India later leading to emergency. Much later this nationalisation lead to extreme corruption. One can say that wrong people took advantage of the turmoil those years.

In all sincerity does Jhunjhunwala agree that the years he was in the market did the brokers not form gangs and manipulate the markets and all ordinary people lost lots of money? Or does he blame that also on dead Prime Minister?

If privatization of bank s will save everything,think again. Subprime crisis, Enron crisis,fall of Anderson s, they were all private.

Good bye http://rakesh-jhunjhunwala.in for ever

Abey jaa …

Thanks always for the updating the readings.

Nice to know what RJ thinks

Indira Ji is dead. She deserves respect. But for all of you in Chennai Modiji is doing his good work without any claims. What have you done ?

https://timesofindia.indiatimes.com/city/chennai/pm-narendra-modi-to-launch-amma-scooters-on-february-24/articleshow/62990654.cms

You can say it however times you want, PSU banks are not going to be privatized for next 10 years. Government has said it time and again, that 1st – political community is not ready for this and 2nd – that PSU Banks do have a national purpose.

The answer for the time being, is merger. Just keep merging them till we have not more than 5 of them.

He doesn’t know the alphabets of political history. Let him speak about investments that will be interesting

Excellent article. Yes Rakesh Jhununwala is 100% correct. All the amateurs here won’t understand the intracasies of his comment. He has much greater understanding of facts than most of the readers here. Like him I have made countless from the stock market by analysing facts for facts. And the fact is Indira was a disaster for the country. She changed election cycles so as to keep India In a never ending election program. She nationalised three major arms of the country. Mohandas Ghandi begged for Indians to destroy congress but everyone laughed at him and Indira, Rajeev and Sonia looted the nation. Any further vote for congress will be a slap to every new born child in India. I don’t say vote for BJP, but let’s hope we get a clean party one day with the leadership and mindset as our PM

having 30 PSU banks is not useful

probably 5-6 is a good number

balancing loan book versus London whale/PNB scenario

India has good banking network…

High time to reward honest borrowers,

start waiving off last 3-6 EMIs for diligent borrowers…have lucky draws every month to waive off loans, both insititutional and personal

Then look at the credit off-take!