Accolades from NAMO ….

Thank you for your kind words. https://t.co/eywX79a4ZX

— Narendra Modi (@narendramodi) March 6, 2017

Porinju kept a straight face and a stiff upper lip. However, the excitement amongst his army of fans and followers gave the game away.

@porinju Woah!!! I am sure the PM doesnt thank every now and then.. Your tweets must have stuck a chord

— Niraj Shah (@_nirajshah) March 7, 2017

@porinju yes Sir, it's great to be greeted by the PM. And see @LittyPorinju Ma'am is your senior here ? https://t.co/xOeej6n4Ea

— Singaraju (@Singaraju_R) March 8, 2017

@porinju @narendramodi National Heros exchanging greetings???✌✌✌

— Kishore Khubchandani (@Bkrrishh) March 6, 2017

@porinju Graceful gesture by the man of masses @narendramodi to another man of India's investing masses @porinju ???

— Sudhir Trikha (@sudhtrik) March 6, 2017

@porinju he is best for nation, u r best for investors…When we have such gems, we need not worry about Khalids, media n left

— Veerendra (@veerendra1971) March 6, 2017

Prima facie, it does appear that the acknowledgement by NAMO of Porinju’s tweet is a big deal. This is because though the investing fraternity in India comprises of several eminent personalities (including two Billionaires), nobody has so far received a direct communiqué from NAMO.

We have to also bear in mind that NAMO, with a follower base of 27.9 million (2.79 crore), is the “most followed leader” on twitter and facebook.

In fact, such is NAMO’s reach and influence that even his arch rivals like Chidu (aka P Chidambaram, the former FM) and Shashi Tharoor, had to grudgingly admit that he is “the most dominant leader” in the World. (i) (ii)

Accordingly, a direct communiqué from NAMO is an event to be cherished.

Porinju is a “Small-Cap Czar”: ET

The Economic Times, which is a dominant newspaper in its own right, has conferred the prestigious title of “Small-Cap Czar” upon Porinju.

Prima facie, this is also a big deal because few from the investing fraternity (with the exception of legendary investors like Rakesh Jhunjhunwala and Radhakishan Damani) can boast of such prestigious titles.

No doubt, Porinju’s famous tweet of 29th August 2013, which has led to two ten-baggers, may have contributed to this rich praise from the ET.

Balaji Telefilms@31, Orient Paper@5, Orient Cement@32, KRBL@23, Mirza Intl@20 – all looking penny stocks, but not penny business. BUY

— Porinju Veliyath (@porinju) August 29, 2013

At this stage, it is notable that Porinju’s recommendation of Reliance Industries, an ultra large-cap, has also worked out well.

Porinju recommended an investment in Reliance Industries in September 2016 on the basis that he is “very bullish” about Jio and that it will churn out “big money” soon.

This has worked out well with gains of about 25% since then. This is commendable because large-cap blue chip stocks like Reliance Industries normally do not move with such agility.

In fact, big-ticket brokerages like Citi are now warming up to the stock and recommending a buy:

1300 for RIL in early trade!! Citi raises target for stock from Rs1195 to Rs1490/share.Bull Case TP of Rs 1923. @BTVI @szarabi @ShailDamania pic.twitter.com/AjUXIen5rN

— Geetu Moza (@Geetu_Moza) March 15, 2017

This implies that Porinju’s expertise is not confined to small-cap stocks but extends to large-cap stocks as well.

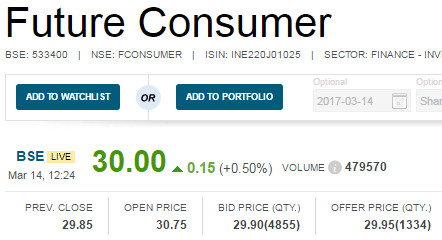

Porinju pockets 200% gain from Future Consumer

When Porinju recommended a buy of Future Consumer in March 2015, even his devoted followers were repulsed and opposed his recommendation.

FCEL | 10.50 – Mgmnt buying consistently!

Only company in the group worth researching; clean balance sheet and futuristic business model!— Porinju Veliyath (@porinju) March 26, 2015

@porinju -what sort of analysis is that? A share capital of 1000 crs and an EPS of .19, what sort of turnaround r u expecting

— Prashant Prasad (@Wowprash) March 26, 2015

@porinju but promoters shares are in pledge & company constantly incurring loss…

— Jimit Zaveri (@lucky_jimit) March 26, 2015

However, the fact is that today, barely 24 months later, Future Consumer is standing tall at Rs. 30, meaning that Porinju’s portfolio is richer by a massive gain of 200%.

All tym high on Future Consumer..Sweet move of 10%..N 1Cr volume in NSE alone..tomo shud b abv 30..:) Future retail following too..??

— Shreenidhi P (@nid_rockz) March 7, 2017

Understandably, Porinju could not resist patting himself on the back.

2 years – 3 times!

Bullish on #ChangingIndia https://t.co/6HqWeJzTNp— Porinju Veliyath (@porinju) March 9, 2017

More gains are on the anvil from Future Consumer & Future Retail?

Kishore Biyani, the visionary boss man of the Future Group, assured that Future Retail will see revenue growth of 20-25% over the next 2-3 years and that the sales of Future Consumer will hit the Rs 20,000 crore mark by 2020-21.

He also promised that the Future Group will become debt free in less than 4-5 years. He added that the group has completed the reorganisation of businesses and is working towards strengthening the balance sheet to grow faster.

FCEL to grow 80% fo next 2 yrs, FRL at 30% fo 2-3 yrs n Future Group to b debt free in next 4yrs?Holding FCEL N FRLhttps://t.co/c8H3oyEVcO

— Shreenidhi P (@nid_rockz) March 9, 2017

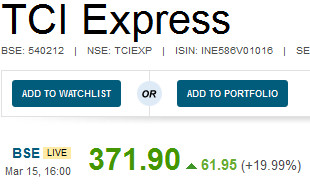

TCI Express surges 20%

It seems like yesterday that Porinju advised a buy of TCI Express on the logic that it could become the “next Blue Dart”.

Can TCI XPS go the Blue Dart way? Core holding in PMS; always liked TCI than VRL:-) Latest presentation on BSE:https://t.co/xzSPAb49rW

— Porinju Veliyath (@porinju) June 3, 2016

Today, TCI Express sprang like a rocket to surge 20%.

It is not known what the provocation was for the stock to behave in this manner though it can be speculated that some big ticket investors are aggressively tucking into it.

Darshan Mehta, the journalist with ET Now, succinctly summarized the salient features of TCI Express:

TCI Express Buzzing

– B2B is 95% of revenues

– Aims to grow at 15-20%

– Operates 3500 trucks but doesn’t own them

– High RoCE biz ~40%— Darshan Mehta (@darshanetnow) March 15, 2017

With exponential growth in Q3, FY17- TCI Express is proud to spearhead the industry, #DeliveringExpectations all the way. pic.twitter.com/wafLu8qStj

— TCI Express Care (@TCIExpressCare) February 3, 2017

Is Transport Corporation (TCI) following suit?

TCI also put up a robust show today, prompting Porinju to send the subtle signal that the stock should be bought as it also has a long way to go.

Another simple business for beginners to study:https://t.co/2xD06YCf20

— Porinju Veliyath (@porinju) March 15, 2017

Prediction of Nifty at 9100 comes true. What about the Nifty at 12-13,000 prediction?

Porinju’s famous prediction that the Nifty will surge to 9,100 has come true now.

If @HillaryClinton wins Nifty will touch 9120 in 6 months, if @realDonaldTrump win Nifty will cross 9120 in 6 weeks; though I like neither ?

— Porinju Veliyath (@porinju) November 2, 2016

It took a week more since Trump's inauguration ? https://t.co/oeuRaHKdfv

— Porinju Veliyath (@porinju) March 15, 2017

Now, the moot question is whether his ultra-bullish prediction that the Nifty will surge to 12-13,000 in the next couple of years will also come true.

.@porinju: Believe Nifty50 can go to 12,000-13,000 in next 2 years pic.twitter.com/Jh0CI674AW

— ETMarkets (@ETMarkets) February 23, 2017

New stock recommendations by Porinju Veliyath

NAMO’s stupendous victory in the UP elections has understandably further fuelled Porinju’s bullish tendencies.

He prophesied that India will become a “$10 Trillion GDP” in the next 10 years and that investors will take home massive riches if they buy the right stocks and sit tight.

Are you ready for $10 Trillion GDP in 10 Years?

Historic Leader, accepted by all 'Knowledgeable+Good' Indians & a High Potential Economy!— Porinju Veliyath (@porinju) March 12, 2017

.@porinju: RIL Has Great Growth Potential Going Ahead; Also Positive On Lakshmi Vilas Bank pic.twitter.com/kc6pF1lDmd

— BTVI Live (@BTVI) March 14, 2017

He also recommended the following stocks:

(1) HSIL: Porinju assured that HSIL, a manufacturer of sanitary ware, will benefit from the affordable housing initiative.

(2) TCI: This logistics small-cap has the wherewithal to deliver mega gains Porinju promised.

(3) Federal Bank, South Indian Bank and Lakhsmi Vilas Bank are three mid-cap private banks which can become multibaggers Porinju opined.

(4) Persistent Technologies & Tata Elxsi:

Porinju has developed a fascination for “futuristic technology” companies like Persistent Systems and Tata Elxsi. He claims that these companies are engaged in “disruptive technologies” like “data analytics”, “self driven cars” etc and that a bright future beckons them. He added that Persistent has got a tie up with IBM and that things can become “very big” for it.

Conclusion – We are in the right place at the right time!

It is obvious that we are in the right place and at the right time. We cannot afford to be complacent at this stage but have to stay on red alert to cash in on the shower of multibaggers that are coming our way!

Dredging Corp is up 60%

When was Persistent Systems recommended and at what price?

I learnt you have funds management team and would like to join or invest per your reply