Dalal Street erupts in joy after Nifty surges to 12345

“Trump bhai aur Khomeni bhai mein compromise ho gaya hai. Ab koi tension nahi,” Mukeshbhai announced, flaunting his knowledge about Global affairs.

“Bindaas stock lo. Solid profit hone wala hai,” Jigneshbhai added.

The two stalwarts of Dalal Street were as usual correct in their analysis.

The easing of tensions between USA and Iran led to the stock market surging upwards like a rocket.

In fact, the Nifty touched the level of 12345 for the very first time ever in the history of mankind.

Naturally, there was much jubilation all around, with delirious punters dancing in joy, their pockets bulging with hefty gains.

#MarketAtRecordHigh | #Nifty crosses the psychological level of 12,345 pic.twitter.com/9wgyTWGHzs

— CNBC-TV18 (@CNBCTV18Live) January 14, 2020

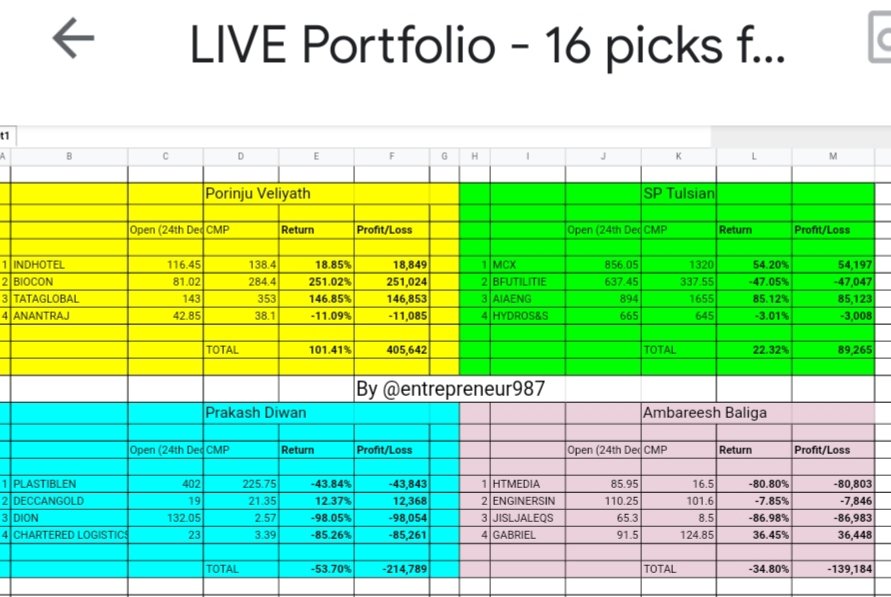

Porinju Veliyath’s stock recommendations give 100% gain

However, everyone’s attention was riveted towards one section of Dalal Street where Porinju and his massive follower base of 1 Million+ were holding fort.

The results of the stock-picking championship had just been released.

To everyone’s surprise, Porinju had trounced the other competitors and come to the top of the rankings.

His recommendation of four stocks has delivered an average return of 100%, which is quite impressive.

It should be borne in mind that the recommendations were made at the peak of the Bull market, when stocks were already quoting at exalted levels.

S. P. Tulsian, the veteran stock picker, came a distant second with an average return of 22%.

Ambareesh Baliga couldn’t make the cut. His recommendations lost 35%.

Prakash Diwan also disappointed sorely with a hefty loss of 54%.

Came across this. Guess who is beating the markets.

Pic 1) His picks Dec 2015

Pic 2) From June 2019@porinju keeping his faith in Tata Global pic.twitter.com/WkBaWTtY9K

— Kush Katakia (@kushkatakia) January 14, 2020

Biocon, the star of the portfolio

Biocon is the star of Porinju’s portfolio with a mammoth gain of 251%.

Old-timers may recollect that Porinju had defied the mighty CLSA to recommend Biocon as a “great pick” and “high conviction bet”.

Why Biocon is a Great Pick:

My high conviction bet. Confident on @kiranshaw & @Bioconlimited

Holding in PMS & Prop.https://t.co/l6ahQsnIf5— Porinju Veliyath (@porinju) January 6, 2016

Kiran Mazumdar Shaw, the illustrious Billionaire founder of Biocon, supported Porinju and trashed CLSA.

She boldly described CLSA’s report as “illogical” and reflecting “poor understanding of huge opp for Biosimilars”.

CLSA "sell" report on Biocon is illogical n reflects poor understanding of huge opp for Biosimilars Axis has a "Buy" on Biocon on same .

— Kiran Mazumdar Shaw (@kiranshaw) January 6, 2016

Thankfully, the conviction of the duo has reaped rich rewards.

Porinju’s recommendation of Tata Global was also brilliant.

The stock is presently on an unstoppable surge owing to benefits arising from the deal with Starbucks and Brexit.

Tata Starbucks Revenues

2014 : ₹95.4 Crore

2015 : ₹168.9 Crore (Up 1.7x)

2016 : ₹234.48 Crore

2018 : ₹267.2 Crore

2019 : 443.6 Crore (Up 1.7x)(Starbucks India operates 170 stores in India)

— Priyesh A Chokshi (@priyeshchokshi) January 14, 2020

No doubt, the stock is a blue-chip powerhouse with a lot of steam left in it.

The stock is also expected to be included in the prestigious MSCI Std index.

Obviously, if that happens, the stock will witness more aggressive buying from deep-pocketed Funds.

Tata Global in focus

If TGBL is included in MSCI Std index, then the stock should see inflows of $ 129mn | 23mn shares | ADV 6.4x. : Edel— Darshan Mehta (@darshanvmehta1) January 14, 2020

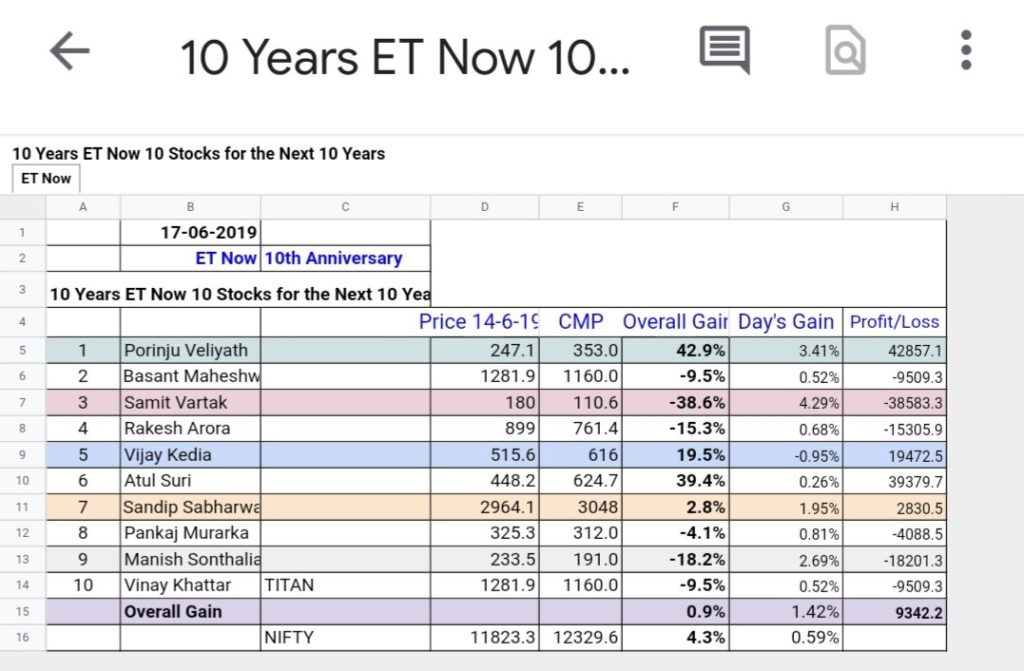

Pole position also in ‘ETNow 10 stocks for 10 years’

Tata Global also came to Porinju’s rescue in the ‘ET Now 10 stocks for 10 years’ jamboree.

It propelled him to the very top with a massive return of 43%.

Atul Suri came second because HDFC Life, his stock recommendation, delivered a stunning 39%.

Atul Suri has recommended HDFC Life as a ‘TINA’ stock to us and assured that it has lot more multibagger gains in store for us.

Repro, Vijay Kedia’s recommendation, also posted a respectable return of 20%.

Samit Vartak found himself at the bottom of the barrel with a loss of 39%.

However, he cannot be blamed for this fiasco because Edelweiss, the recommended stock, got into a soup over alleged NPA loans and FERA violations.

Rashesh Shah, the Billionaire founder of Edelweiss, has issued a clarification that all allegations of FEMA violations are false.

Assure you that Edelweiss has no relationship with Capstone Forex. All allegations of FEMA violations are false, says @rasheshshah of @EdelweissFin @uttkarsh311090 pic.twitter.com/Gs95haEB0h

— ET NOW (@ETNOWlive) January 12, 2020

Hopefully, all is not lost yet for the beleaguered shareholders of Edelweiss and the storm will pass sooner than later.

2020 will reward the resilience of small and mid-cap investors

Porinju has already alerted us that there is a wide disparity between the valuation of large-cap stocks and their smaller counterparts and that a ‘mean reversion‘ is round the corner (see I Got Carried Away By Bull Market And Lost Money But Now Expect Mega Gains From Small-Cap Stocks).

“I have never seen such a disparity before … I am not just talking about midcap or smallcap indices, but the broader market, where most non-institutional investors are concentrated. The value gap between largecaps and smaller stocks is unprecedented,” he stated.

“Many stocks may surprise people at some point, as investors have turned hopeless on smallcaps even when they trade at just 3-5 PE multiples, but are growing at 15-20 per cent and offering 3-6 per cent dividend yields. Many of these stocks would spring a surprise,” he added.

Porinju’s theory is corroborated by other experts as well.

So, it is quite clear that we have to grab the top-quality small-cap and mid-cap stocks ASAP and wait for the tide to turn!

Ha ha.. thank you Kush for highlighting the brighter side? Wish I could replicate this in PMS too, pained by the grave underperformance of two years. Hope 2020 rewards the resilience of all small/mid-cap investors!

— Porinju Veliyath (@porinju) January 14, 2020

Does Porinju pay you to praise his achievements? His PMS is still idown more that 50% and the subscribers have lost millions. Sad!

Exactly ! If I see one more post on this guy I am quitting following this blog. This blog has become a marketing blog for Porinju Veliyath.

This Blog gives so much information, I found my Multibagger stock from here when someone was complaining why the blog promoting this particular company. I reckon, it’s best to use your own brain than jumping on any conclusion. The info shared here can be used to educate yourselves and not to take decision based on what Porinju bought or sold.

Keep up the good work guys.

Cheers

There is at least a dozen more names from Porinju that made many multi beggars, but still the author of this blog tries to glorify him.

Finally retail investors here started rolling their brains. It is a good sign