It is well known that there are only two Indians from the investing fraternity who are allowed to enter the hallowed gates of the Forbes Billionaires’ Club.

The first is our own Rakesh Jhunjhunwala, the Badshah of Dalal Street. The second is Radhakishan Damani, who is revered by Rakesh Jhunjhunwala as his guru/ mentor.

While Rakesh Jhunjhunwala is a long-standing and permanent member of the Forbes Billionaire’s club, Radhakishan Damani made his debut in 2014 with a relatively modest net worth of $1 Billion (Rs. 6,500 crore).

Unfortunately, Radhakishan Damani’s tenure in the Billionaires’ club was short-lived. A savage Bear market caused the veteran investor’s net worth to plunge below the high water mark of $1 Billion and his name was surreptitiously deleted by Forbes from the list of Billionaires of 2016 (see Bear Market Claims First Victim As Radhakishan Damani Loses Exalted Status Of Forbes Billionaire).

At that time, I had confidently predicted that there is no need for us to despair because Radhakishan Damani would again storm back into the elite club.

That prediction has now come true.

Radhakishan Damani’s net worth has now soared to an eye-popping Rs. 24,000 crore which is equal to $3.6 Billion.

RK DAMANI's portfolio (Top 3)

VST Ind: Rs 1176 cr

Sundaram Finance: Rs 414 cr

Blue Dart: Rs406 cr— Varinder Bansal (@varinder_bansal) March 21, 2017

(RK Damani and Neville Noronha with the BSE chief at the listing ceremony – Neville Noronha has pocketed gains in excess of Rs. 500 crore from the IPO)

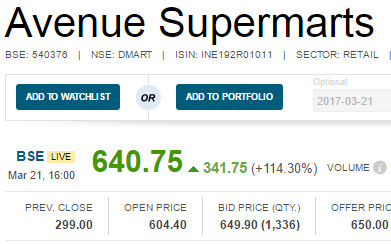

Record breaking IPO Debut by D-Mart

D-Mart soared an eye-popping 114% today on the first day of its listing and closed at Rs. 641.

The ET pointed out that this is the biggest listing gains in the last decade. No IPO has in recent times given the sort of gain that D-Mart has given.

The record was so far held by Quess Corp with a listing gain of 57.41 per cent. Thyrocare Technologies was next with 48.43 per cent gain followed by Advance Enzyme with 35 per cent gain.

Best IPOs by return since listing in last 15 years #DMart pic.twitter.com/uqEOJS9O3R

— Ankit Chaudhary (@entrepreneur987) March 19, 2017

Unbelievable demand for D Mart….630 now

— Darshan Mehta (@darshanetnow) March 21, 2017

Avenue Supermart Dmart market Cap now over 40K cr

— Darshan Mehta (@darshanetnow) March 21, 2017

However, Shraddha Babla, the charming journalist with Bloomberg, claimed that V2 Retail had recorded a higher premium on listing:

#DMart (Avenue Supermarts) ended with 115% gains on market debut.

But guess what:Smaller peer V2 Retail had ended 178% higher on listing day— Shraddha Babla (@shraddha_babla) March 21, 2017

(Vallabh Bhanshali and Nimesh Shah at the listing ceremony, thrilled at the hefty gains)

Net worth is more than that of heavy-duty industrialists?

The ET computed Radhakishan Damani’s net worth at $6 Billion on the basis that he and his family members (include Bright Star Investments and Derive Investments) held 91 per cent stake, or 51,29,10,000 shares, in D-Mart before the IPO.

Radhakishan Damani’s networth is more than that of big-ticket industrialists like Rahul Bajaj ($3.5 billion), Anil Agarwal ($3 billion) and Anil Ambani ($2.7 billion), the ET said in a tone of great excitement.

If this is true, then it is a matter of great pride for all of us in the investing fraternity.

Mr.R.K.Damani is now richer than @travisk . Not to mention that he has also surpassed Anil Ambani, Anil Agarwal and Gautam Adani. #DMart

— Kush Katakia (@kushkatakia) March 21, 2017

Some also pointed out that the market capitalisation of DMart is more than that of the MNC FMCG companies whose products it sells for a small commission.

DMart Sells Biscuits & FMCG Pdts

For Perspective –

D Mart MCap: 39500 Cr

Britannia at 38400

Marico at 37700 Cr— Mangalam Maloo (@blitzkreigm) March 21, 2017

#DMart market cap currently at Rs 37,000 crore, higher than @ideacellular, @IndiGo6E & @Indiapnb

— ETMarkets (@ETMarkets) March 21, 2017

It took Mr Damani 16 long yrs to create a value of Rs 299/share #DMart . It took seconds for markets to double it. @BTVI @szarabi #equity pic.twitter.com/pxqfz0WhmE

— Geetu Moza (@Geetu_Moza) March 21, 2017

Ace investors congratulate Radhakishan Damani

Naturally, all the ace investors and experts rushed out to congratulate the savvy Billionaire on his amazing achievement.

RKD is an inspiring, Humble Soul too – when we met last year he was using an old Nokia phone; I struggled to feed my new number into it ? https://t.co/s2kCtcHdJ5

— Porinju Veliyath (@porinju) March 21, 2017

Indian market salutes Radhakishan Damani. His stocks are all having a blast out there. Market's RDx day. #DMart #dmartipo

— Shyam Sekhar (@shyamsek) March 21, 2017

RK DAMANI – HUGE RESPECT.

Not even a single word spoken on listing. As they say "Work hard in silence, let your success be your noise" pic.twitter.com/KHJ5DdsUey— Varinder Bansal (@varinder_bansal) March 21, 2017

Today is a historic day for some of the icons of stock markets. #DMart lists with market cap of 37,000 cr. Momentous day!!

— Anuj Singhal (@_anujsinghal) March 21, 2017

(Samir Arora hobnobs with RK Damani but forgot to ask for an allotment of DMart stock)

Timing is everything:

The precise moment when I should have asked for an allocation in Dmart. pic.twitter.com/ZXfjwpNPuW

— Samir Arora (@Iamsamirarora) March 12, 2017

But how come the savvy investor left so much money (Rs. 1,000 crore) on the table?

Some ace investors were quick to point out that Radhakishan Damani appears to have underestimated the demand for the stock of his company and he grossly under priced it.

SP Tulsian was charitable and called it a “goodwill gesture“. He lamented that if the issue had been priced correctly, the Company could have effortlessly pocketed an additional Rs. 1,000 crore.

A similar view was expressed by Shyam Sekhar, the noted value investor:

RKD, an Ace investor sold #DMart stock only to find investors ready to pay twice the price in a week. So stop.cribbing when you sell cheap.

— Shyam Sekhar (@shyamsek) March 21, 2017

50 shares of D’Mart can buy a posh 3BHK in 2037?

Some experts joked that DMart would compound at such a furious pace that its lucky investors will rake in a massive fortune in the foreseeable future.

50 shares of DMart allotted! Never going to sell them, will buy a 3BHK in Bandra with these 50 shares in 2037! ???

— Anupam Gupta (@b50) March 18, 2017

Ok I was joking but…. pic.twitter.com/rmEp5L3OUz

— Anupam Gupta (@b50) March 18, 2017

Is D-Mart still a good stock to buy or is it a case of “irrational exuberance”?

Now, the million dollar question is whether D-Mart is still a good stock to buy and whether novice investors like you and me should storm the counter and grab a chunk for our own portfolios.

Porinju Veliyath has given us the green signal in this behalf:

“D-Mart is a wonderful company and is going to grow much more. It can be a 5x company in the next 10 years. That’s the kind of potential that the company has. It is a well-managed company,” he said implying that D-Mart may overtake Future Consumer (FCEL) in the race for multibagger gains.

A similar opinion has been expressed by Ayaz Motiwala of Nivalis Partners. He opined that as the floating stock is meager and the institutional investors are not going to share the loot, the only solution is for us to storm in and make a desperate grab:

“If I am looking at it as a business, which is producing this kind of cash and profitability and you have a three-five year outlook as it settles down because the liquidity is going to be challenged and there is probably there about 10% kind of float and some of these institutional allottees and anchor etc may not just sell. With that, it may make sense to be participating in the first few days if you really want to own the stock in size and for the long term,” Ayaz Motiwala opined.

S Ramesh of Kotak pointed out that a number of big-ticket institutional investors are unsatisfied at the meagre allotment that they have got in the IPO and that they will maintain a 24×7 vigil at the counter, eager to snap up the stock on every correction.

This implies that the stock price will never correct in a meaningful manner.

He also gave the Company a clean chit by emphasizing that it has “excellent fundamentals” in the form of high ROCE, ROE, top line and bottom line growth, future growth prospects and visionary management.

However, Arun Kejriwal and other experts condemned the entire episode as one of “irrational exuberance“. “I find it very difficult to buy D-Mart at this valuation. It reminds me of the heydays of retail stocks,” they said in a grim tone.

Some other experts echoed this view and opined that the valuations are now stretched with all positives priced in and that there is unlikely to be a meaningful price gain now. They added that there are better options available in the market.

Shyam Sekhar, the noted value investor, also made his contempt for the “irrational exuberance” clear:

Dalal Street advances #AllfoolsDay by 11 days. PE for Rent.

Celebrations begin shortly at the Ceremonial Bell. All are welcome? #DMart— Shyam Sekhar (@shyamsek) March 21, 2017

So the game being played in #DMart is this.

"If you dont buy today, you may not get quantity tomorrow. Float may be less." WoW.

— Shyam Sekhar (@shyamsek) March 21, 2017

Conclusion

In the light of the divided opinion of the experts, it appears that for the present we will have to rest content with merely congratulating Radhakishan Damani on his incredible achievement and will have to postpone our plans to storm the counter. Perhaps, if the stock price corrects in a meaningful manner, we can tuck into the stock in a slow and steady manner and partner the savvy Billionaire on the road of endless wealth creation!

So much euphoria. It will not sustain for long. Crazy debut. It is difficult to become a multibagger with this kind of market cap.

you are right. i have booked the profit. in fact, no retail company is cheap at this stage.

Does this frenzy signify a short-term market top?

The Gentleman sitting with Vallabh is Nemish Shah of erstwhile ENAM.

Shyam Shekhar is clearly not in a mood to suggest Dmart at this price.