Billionaire Nirmal Jain fulfills promise

The demerger of the IIFL Group into IIFL Finance, IIFL Wealth and IIFL Securities was a non-event on Dalal Street.

Most local punters like me were not even aware of the demerger.

However, Sunil Singhania, the founder of Abakkus PMS Fund, was keeping a hawk eye on the three stocks.

This is because Nirmal Jain, the self-made visionary Billionaire founder of IIFL, had made the solemn promise that “By separating the three entities, we will allow them to grow to their full potential“.

R Venkataraman, the distinguished MD of the group, had also assured that “The reorganisation will prepare the IIFL group companies for the growth opportunities amid intensifying competition in the coming decade“.

On 27th November, a few weeks after IIFL Securities listed on the Bourses, Sunil Singhania pounced on the stock with no holds barred.

His Abakkus Emerging Opportunities Fund bought 27,12,220 shares while the Abakkus Growth Fund bought 60,00,000 shares.

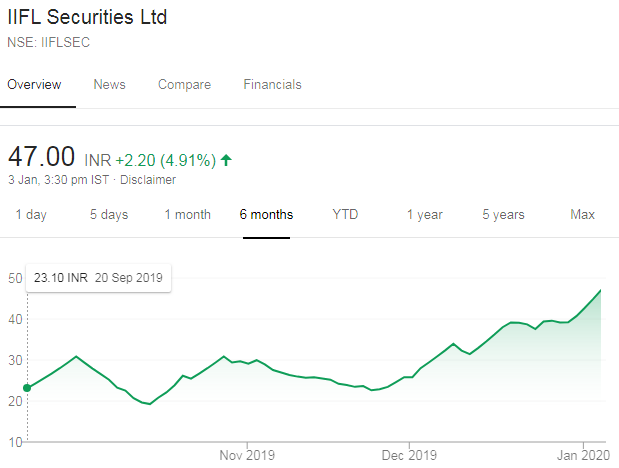

The total investment made was Rs. 21 crore, at the throwaway price of Rs. 24 each.

The stock is presently quoting at Rs 47, which means that Sunil Singhania and his investors are basking in mammoth gains of nearly 100%.

Thank you!

— Sunil Singhania (@SunilBSinghania) January 2, 2020

(Sunil Singhania with his team members)

Billionaire Satpal Khattar encashes gain, Rakesh Jhunjhunwala buys his stake

Satpal Khattar is also an astute investor.

We are very familiar with his investing philosophy and the many multibaggers in his portfolio.

In fact, one of his micro-cap stock picks is said to be “at cusp of unprecedented opportunities” and is strongly recommended by leading experts.

Satpal Khattar held 62,16,528 shares in IIFL Securities as of 30th September 2019.

On 2nd January 2020, he sold 30,00,000 shares at Rs. 42.74 each.

Of this, Rakesh Jhunjhunwala‘s Rare Enterprises bought 27,84,879 shares.

Rakesh Jhunjhunwala is known to have a penchant for brokerage stocks.

He already holds big chunks of Edelweiss and Geojit in his portfolio.

#RakeshJhunjhunwala buys 27.85 lakh shares of #IIFLSecuritieshttps://t.co/c32xBeWrYV

— ETMarkets (@ETMarkets) January 2, 2020

SEBI’s crackdown on dubious brokerages and margins augers well for IIFL Securities

I reported earlier that the alleged scam of Rs. 2000 crore by Karvy Broking has sent shock-waves across Dalal Street.

Karvy is alleged to have siphoned off clients’ funds and pledged their holdings for its own nefarious purposes.

Even with all the regulations, inspections, monitoring etc scams of larger and larger proportion keep on happening#KarvyBroking banned by #SEBI for transferring Rs 2000 Cr worth client shares to itself and using them to fund Karvy Realty.

Crazy— sandip sabharwal (@sandipsabharwal) November 23, 2019

However, the positive effect of the fiasco is that panic-stricken investors are bolting from dubious brokerages and flocking to reputed brokerages like IIFL Securities.

Also, SEBI has also launched a crackdown on the practice of brokerages offering massive leverage to day-traders.

Some dare-devil brokers are alleged to be offering upto 500x leverage in a desperate bid to lure clients.

Nithin Kamath, the visionary Billionaire founder of Zerodha, has provided a masterful explanation of the impact of SEBI’s move.

The latest clarification from the exchanges requires all brokers to collect minimum margins before a trade — VAR+ELM for equity, SPAN+Exposure for FO, even for intraday trades! All brokers same in terms of leverage and low leverage isn't necessarily bad. https://t.co/XWOMVvPR99

— Nithin Kamath (@Nithin0dha) January 2, 2020

SEBI’s crackdown on margins & leverage has met with mixed reactions from traders in Dalal Street.

Some described it as “horse crap” and condemned SEBI for behaving “like a Bull in a China shop“.

This is dog shit from SEBI. I request all traders to unite and protest. Going forward, I need to rethink if SEBI will even encourage retail traders like me to make a living here in India. Absolute horse crap ? https://t.co/JeHNZwMx6J

— Sunder (@SunderjiJB) January 2, 2020

Regulators are behaving like bulls in China shops. Horribly conceived Policies issued as dictats with no consultation by Bureaucrats who have no concept of reality. Telecom, Insurance, Payment Gateways, Broadcasting, Corporate Law..no area seems safe. Will the Govt reign them in?

— Pran Katariya (@KatariyaPran) January 3, 2020

However, others lauded the move and claimed that it is beneficial and will protect the entire system from risk.

Nithin Kamath welcomed the move by stating that “it is good for the ecosystem in the long run“.

He also pointed out in a pithy manner that “Higher the leverage, higher the chance of panic when trades go against you, and higher the odds of losing“.

Other experienced traders echoed this viewpoint.

Regarding the recent SEBI directive on margins, this is a much needed and welcome step. Absurd intraday leverage offered by some brokers exposed the system to systematic risks . If allowed to continue , all of us would have been at risk

— Subhadip Nandy (@SubhadipNandy) January 3, 2020

As such options are leveraged instruments . Providing even more leverage as was being done now on Indian markets were pretty insane . So a much needed welcome step IMHO

— Subhadip Nandy (@SubhadipNandy) January 3, 2020

Increased intraday margin requirement by sebi is not an bad step as perceived by many

It may brings more stability to markets , hard to manipulate due to increased margins

Positional players likely to get more advantage , 1/n

— Rahull (@rahullkrr) January 4, 2020

Giving Leverage 10-20-30 x is Harmful & risky not only 2 traders who takes over leverage & trade but also 2 brokers and other traders who dont take over leverage or who dont trade intra day at all, My opinion Leverage should be limited to 3-5 x and not stopped, Please comment

— AA (@anilbalaji11) January 4, 2020

The move by #SEBI should take the industry back to how it was for retail.

Over the past 4 years, option selling became too big cos of the leverage factor. This would reset

Retail mostly traded options over futures, so there won't be much change there. They were always buy side

— Shai (@Am_Shai) January 4, 2020

No Intraday Leverage – SEBI Circular (If Implemented)

Impact Analysis.

1. Intraday Option Selling/Expiry Trading honey moon period may be over.

2. Weekly Options craze may come to an end.

3. Big Fat MTM screenshots post expiry may be the thing of the past.— Sunder (@SunderjiJB) January 4, 2020

If we go with current format, where few brokers are providing as high as 40x to 500x leverages, in this case if regulator directly allows spread risk based margin, then volumes will increase many folds. So this is right step provided very soon we see spread risk based margin.

— Santosh Pasi (@SantoshPasi) January 3, 2020

IIFL Securities vs. ICICI Securities

Jwalit Vyas of ET Bureau has conducted a systematic analysis of the prospects of various listed brokerages including IIFL Securities, ICICI Securities, Motilal Oswal and Edelweiss.

He has opined that SEBI’s margin norms may put smaller brokerages out of business as their business model will no longer will be viable and that the beneficiaries will be the bigger brokerages.

Broking industry is changing rapidly and radically- Mr R Venkataraman (@venkataraman_27) MD, IIFL Securities speaks on the future of stock broking industry at @ETMarkets Global Summit #ETMGS @ETNOWlive @EconomicTimes @IIFLMarkets pic.twitter.com/jwrUJHjYEw

— Nirmal Jain (@JainNirmal) November 22, 2019

Proud to share this prestigious award won by IIFL Finance- Risk management is core to survival and growth of any lender.. pic.twitter.com/m5sqqDF0DB

— Nirmal Jain (@JainNirmal) December 19, 2019

He has also claimed that ICICI securities offers better business growth (five-year annual growth of 13.5 per cent in brokerage revenue compared with 9.3 per cent in the case of IIFL), higher return on equity (over 50 per cent in FY19 compared with 25 per cent for IIFL) and the strong backing of ICICI Bank.

However, the wide valuation gap between the two makes the stock of IIFL Securities cheaper, it is stated.

It is also pointed out that while ISec and IIFL are sufficiently capitalised with net worth of Rs 1,080 crore and Rs 870 crore, respectively, the latter trades at a price-book (P/B) multiple of 1.4 compared with 12.2 for ICICI securities.

In addition, IIFL’s FY20 expected price-earnings (P/E) multiple is 10, which is lower than 23 for ISec.

Also, at the end of November 2019, ISec had the second highest market share of 10.3 per cent in terms of active clients while IIFL’s share was 2.2 per cent.

Karvy had a market share of 3.1 per cent, which is expected to percolate amongst the other incumbents.

It is also stated that Edelweiss and Motilal Oswal have a different business model because they also have exposure to lending business.

So, what is the final decision – IIFL Securities or ICICI Securities ?