Only buy stocks with 5x multibagger potential: Mohnish Pabrai

Mohnish Pabrai, the internationally renowned stock picker, was the first to send the clarion call that novice investors should dream big.

“We are not interested in buying any stock if it does not have 5x multibagger potential”, Mohnish said with his usual flourish even as Guy Spier, also an internationally renowned investor, nodded his head vigorously in agreement.

Mohnish Pabrai has several potential multibagger stocks in his portfolio such as Rain Industries, Balaji Amines, Kolte-Patil, Sunteck Realty etc.

He also indicated that he regards Ajay Piramal as “India’s Warren Buffett” and Piramal Enterprises as “India’s Berkshire Hathaway”, implying that we can buy the stock without a second’s thought.

Shyam Sekhar approves of the ‘think big’ philosophy

Shyam Sekhar, the noted value investor, approved of Mohnish Pabrai’s investment philosophy of always thinking big. He called it a “life changer”.

I fully agree with @MohnishPabrai Dont look at anything<5X. A peer told me the same thing over a lazy lunch 11yrs ago. Lifechanger

— Shyam Sekhar (@shyamsek) February 28, 2017

Shyam Sekhar has several mega multibagger stocks like Jayant Agro, La Opala, Balaji Amines, Hatsun Agro, KRBL, Prima Plastics, HDFC Bank etc sparkling in his portfolio and so we cannot take his advice lightly.

Look at stocks which have “excitement“: Porinju Veliyath

Porinju Veliyath has also endorsed this approach to buying stocks.

“I look at stocks only when there is excitement. If somebody says a stock will go up by 20-30 percent I’d rather keep my money in a fixed deposit,” Porinju said, making it clear that we have to always aim for multibagger gains.

Porinju’s investing prowess is so well known that it does not have to be recounted. We have benefitted enormously from his liberal and open-house approach of sharing stock ideas and recommendations.

Good companies do not excite me: Shankar Sharma

“Coming to consumption, I do not find troubled companies. I find good companies. So it does not excite me. I am not entering stock market to make 15-20%. Unless I look at 100% return, I am better out doing my fixed income,” Shankar said in his deep baritone.

Five mantras of Shankar Sharma

Shankar has earlier revealed to us his five top-secret mantras for finding multibagger stocks.

The unique aspect about Shankar’s mantras is that they help pick stocks which are “fail-safe”.

The stocks are in such a worst-case scenario that it is impossible for them to lose further ground.

On the other hand, a slight uptick in their operational parameters sends them surging into the stratosphere and delivers multibagger gains to the delighted shareholders.

Apple, Amazon & IndusInd Bank sparkle in Shankar Sharma’s portfolio

Shankar’s investing mantras helped him home in on stocks like Apple, Amazon & IndusInd Bank when they were languishing unwanted and unloved and were available at throwaway valuations.

Needless to say, these stocks are now much coveted by investors owing to their powerhouse credentials.

Best stocks to buy now

Shankar made it clear that he is now very bullish about the steel sector.

“I have been very bullish on steel. Steel has been a terrific sector. If you look at all steel or mining companies in India or globally, they have done phenomenally well. That has been a big sectoral bet in my view.”

Shankar also reiterated his bullishness for chemical commodity stocks.

“In other commodity space, commodity chemicals again bombed out. Since 2013-14, there has been bit of upturn globally, stocks have been up,” he said.

Increasing Steel Production In China Good For Iron Ore Industry

Shankar’s theory that the steel industry is undergoing boom time has met with support from Narendra Kothari, the former Chairman of NMDC. It is obvious that Narendra Kothari knows everything that is there to be known about the metals sector.

He opined that the increasing steel production in China augers well for the iron-ore Industry. He also pointed out that iron ore prices had plunged 20% drop in May, bringing cheer to steel companies. However, the ore prices will not go below $50/tn, he opined.

Which is the best steel stock to buy?

Shankar’s advice means that we have to roll up our sleeves and hunt for the best steel stock to buy.

Prima facie, Tata Sponge Iron, the blue-chip small-cap, appears to be the best bet.

Daljeet Kohli has carefully analyzed the stock and given the green signal on the basis that we cannot go wrong due to the blue-chip pedigree, zero debt status and high cash balance of the stock.

In fact, Tata Sponge Iron has already given a hefty gain of 41% since Daljeet’s recommendation of August 2016.

Tata Metaliks, also a blue-chip small-cap, is the other steel stock that we can ponder about because Mudar Patherya and Dolly Khanna have given it a certificate of merit.

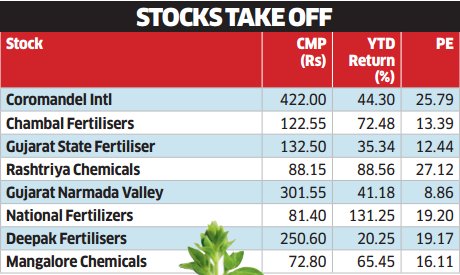

What about fertilizer stocks?

Shankar maintained a conspicuous silence about fertilizer stocks.

However, given that Dolly Khanna has made her debut into the sector by buying a top-notch fertilizer-cum-chemical stock, we cannot stay aloof from the sector.

(Image credit: ET)

According to a report in the ET, fertilizer companies are likely to outperform the market in the coming months, helped by the government’s policy changes in the subsidy regime from kharif season, high likelihood of government clearing past subsidy dues and the onset of monsoon from June.

The report has quoted leading experts in support of the proposition. It has also named fertilizer stocks which are potential multibaggers.

Conclusion

It is obvious that novice investors have to tread with utmost caution. In seeking “excitement”, we shouldn’t step on a landmine and lose even the paltry gains that we have been eking out so far. We shouldn’t touch a stock unless it has been cleared as being investment-worthy by trusted experts!

Agree 100%. Buy stocks which have zero downside but huge upside. One such stock is Suzlon. Its out of favour but its fundamentals are improving by the day. From the depressed valuations it can turn out to be a multibagger.

I agree… will be a multibagger.

GMR infra can get back to glorious days after good progress in debt reduction. If you are more adventurous can bet on gvk power and Rcom..It’s a double or quits game..

GMR won contracts in corrupt Congi regime. No chance for them now. Same for GVK. RCom is worth only their tower business. Suzlon is different for two reasons:

#1 They can technically compete with the best in the world.

#2 They have backing of Dilip Sanghvi – one of the most successful businessman in India.

GMR may have won the contracts during Congress regime and were out of favour with the current regiment. But of late, they have patched up with the current government and are expected to do good. Their winning of Goa (Mapusa) airport is an indication of that. Whether it will be multi bagger or not, only time will tell.

However, out of the stocks discussed in the comments section above, Suzlon looks great on all counts.

Rallis India an agrochemical company too deserves to be looked into. It can be a true multi bagger stock.

GMR is in the race to win Greece apt also…

Shankar sharma has good number of stocks in A2Z but that company seems to be going from bad to worst.. No improvement in operating profits… His theory does not seem to working.. What spark or change has he seen in A2Z?

Big bull Rakesh jhujhunwala has dumped his holding at a loss after waiting for many years

Shanker Sharna is bullish now on steel sector ,but where was his advice when tata steel was well below 200 .Shanker sharma advised against pvt banking few years back anf pvt sector sector banks are mocking him with performance. He never come back to guide investers when stocks were cheap but was rather maskot of bears on tv channels. Now in mother of all bull market he is just trying to become relvent.If he is wizard he could have given two three picks for retail invester who are already fed up with mantras for stocks ,without stock specific picks.

what is shankar sharma view about kiri industries now

In 2005or 204 he said that he likes only hul colgate and fmcg companies but up to 20o8 all other coNpanies performed except his picks not only tHis each and every times His prediction has gone wrong totally …Just do opposite to hom

Aby advice on UPL, Wockhardt and Aurobindo Pharm? Chances of appreciation ?